SEBI has framed Investor Charter to promote transparency, enhance awareness, trust and confidence among the investors. The Investor Charter, inter alia, includes the vision and mission statement, rights and responsibilities of investors, investor grievance redressal mechanism and Do’s and Don’ts for investing in securities market. The Investor Charter also gives a broader perspective of various rights and responsibilities of investors.

SEBI has also issued broad guidelines on Investor Charters to the following entities and advised than to develop their own investor charter on the lines of board guidelines:

- Market Infrastructure Institutions (MIIs) Stock Exchanges, Depositories .

- Market Intermediaries, viz., Stock Brokers, Merchant Bankers, RTAs, Depository Participants, etc.

The Investor Charters will help to ensure that all investors have access to clear and concise information about their rights and responsibilities.

Please visit the official websites of respective MIIs and Market Intermediaries to know more about their Investor Charters.

Investor Charter of SEBI

OUR VISION

To protect the interests by enabling them to understand the risks involved and invest in fair, transparent, secure market, and to get services in a timely and efficient manner.

OUR MISSION

- To have streamlined procedures to ensure ease of transacting/investing in securities market for investors.

- To ensure that SEBI registered intermediaries/regulated entities adhere to their investor charters, including grievance redressal mechanism.

- To enable investors to understand risks involved before investing.

- To ensure fair and equitable treatment to investors.

- To ensure confidentiality of information shared by investors unless such information is required to be provided in furtherance of discharging legal obligations or investors have provided specific consent to share such information.

- To analyse the causes of investor grievances on a periodic basis and make appropriate policy amendments if required.

- To provide for alternative dispute resolution mechanism in agreements between investors and Market Infrastructure Institutions/ Intermediaries.

- To encourage innovative and digital solutions in securities market.

INVESTORs have RIGHT to

- Get fair and equitable treatment.

- Expect redressal of investor grievances filed in SCORES in a time bound manner.

- Get quality services from SEBI recognized Market Infrastructure Institutions and SEBI registered intermediaries/regulated entities/ Asset Management Companies including right to exit at fair and reasonable terms from the securities market related product or service and avail Online Dispute Resolution mechanism for the disputes, if any, arising therefrom.

INVESTORs have RESPONSIBILITY to:

- Deal with SEBI recognised Market Infrastructure Institutions and SEBI registered intermediaries / regulated entities only.

- Deal with SEBI recognised Market Infrastructure Institutions and SEBI registered intermediaries / regulated entities only.

- Ensure that grievances are taken up with the concerned entities within time limits prescribed.

- Ensure that their accounts are operated only for their own benefit.

DO’s for Investors:

- Read and understand the documents carefully before investing.

- Know about the Investor Grievance Redressal Mechanism.

- Know the risks involved before investing.

- Keep track of account statements and promptly bring any discrepancy noticed to the concerned stock exchange, intermediary or Asset Management Company.

- Know about various fees, charges, margins, premium, etc. involved in the transactions.

- Preserve relevant transaction related documents.

DONT’s for Investors:

- Don't make payments in cash while making any investment in securities market, beyond the prescribed limit.

- Don't share your critical information like account details, login ids, passwords, DIS, etc. with anyone.

Investor Charter of Stock Exchanges

1. Mission and Vision statement for Investors

-

Mission

- To provide transparent, equitable and reliable markets with timely and accurate information dissemination for investors.

- To provide the highest standards of investor education, investor awareness and investor protection and timely services.

- Vision

To provide a safe, equitable, transparent and trusted platform for investors to participate across asset classes with highest standards of integrity for investors.

2. Business transacted by the exchange wrt investors

The exchange facilitates various products for investors to participate across asset classes viz Equity, Derivatives, Debt, Mutual Funds, Government securities etc. Details available on the link:

https:// www.bseindia.com / markets.html

3. Services provided by the exchanges to investors

Exchange provides various services to investors electronically through its online platform and physically through the dedicated investor service centers set for this purpose. Details available on the link

https: //www.bseindia.com / investor.html

The information on companies listed on Exchange:

https:// www.bseindia.com / corporates.html

4. Grievance redressal mechanism

- (1) Mode of filing the complaints: Complaints can be lodged on the Exchange in the following ways:

- (a) Electronic mode -

- (i) Through SCORES (a web based centralized grievance redressal system of SEBI)

https:// www.scores.gov.in /scores /Welcome. html - (ii) Through Respective Exchange’s web portal dedicated for the filing of compliant

https:// bsecrs.bseindia.com /ecomplaint / frmInvestorHome. aspx - (iii) Emails

For complaints against Trading Members:

https:// www.bseindia.com /static /investors /cac_tm. aspx

For complaints against Listed Companies:

https:// www.bseindia.com /static /investors /Complaint_ against_ Companies. aspx - (b) Offline mode – Physical-

- For complaints against Trading Members:

Complaint form:

https:// www.bseindia. com/ downloads1 /Complaint_ Form_IGRC. doc

Contact details to submit complaint in physical mode:

https:// www.bseindia. com/static /investors /cac_ tm.aspx - For complaints against Listed Companies:

Complaint form:

https:// www.bseindia. com/ downloads1 /COMPLAINT_ FORM.doc

Contact details to submit complaint in physical mode:

https:// www.bseindia. com/ static/ investors/ Complaint_ against_ Companies. aspx - (2) Regarding documents required for complaint resolution and Multi-level dispute resolution mechanism available at the Exchange please refer to link

- Documents required for complaint resolution:

- Complete Account Opening Kit

- Contract notes

- Ledger statement

- Bank statement

- Demat transaction statement

- Any other document in support of claim

- Multi-level dispute resolution mechanism available at the Exchange:

- Amicable resolution at Exchange level

- If no amicable resolution arrived at, matter is referred to Investor Grievance Redressal Committee who are independent entities set up for the compliant resolution.

https:// www.bseindia. com/static /investors /cac_tm. aspx - Arbitration proceedings

- Appellate Arbitration proceedings

https:// www.bseindia. com/static /investors /arbitration_ mechanism. aspx - (3) Timelines for Complaint Resolution Process at Exchanges

| Sr.No | Type of Activity | Expected Timelines for activity |

|---|---|---|

| Against Stock Brokers | ||

| 1 | Receipt of Complaint | Day of complaint (C Day) |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker | C + 7 Working days |

| 3 | Registration of the Complaint and forwarding to the stock broker | C+8 Working Days i.e. T day |

| 4 | Amicable Resolution | T+15 Working Days |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution | T+16 Working Days |

| 6 | Complete resolution process post GRC | T + 30 Working Days |

| 7 | In case where the GRC Member requires additional information, complete resolution shall take place within | T + 45 Working Days |

| 8 | Implementation of GRC Order | On receipt of GRC Order, debit the funds of the stock broker |

| 9 | Complainant/ Broker, if not satisfied, by IGRC decision can avail arbitration mechanism | Within 6 months from the date of IGRC recommendation |

| 10 | In case of receipt of arbitration intention | Obtain an undertaking from the client and pay 50% of the award or 2 lakhs whichever is less to the client from the IPFT, in case GRC order is upto Rs. 20 lacs |

| 11 | Arbitration not filed within 6 months from the GRC Order | Obtain Undertaking from the client and Release 50% amount to the client. Replenish 50% amount to the IPF |

| 12 | Completion of arbitration proceedings | Within 4 months from the date of the final appointment of arbitrator |

| 13 | Completion of appellate proceedings | Within 3 months from the date of the final appointment of arbitrator |

| Against Companies - | (Not Applicable for Commodities Markets) | |

| 1 | Complaint handling | |

| 1.1 | Complaint received in SCORES by the listed company | T day |

| 1.2 | Response to be obtained from Listed Company | T + 30 |

| 1.3 | If no response received, alert to Listed company in the form of reminder for Non - redressal of complaint | T+31 |

| 1.4 | Response to be obtained from Listed Company | T+60 |

5. Rights and Obligations of investors :

For rights and obligations please refer to the link

https:// www.bseindia. com/ static/ investors/ Rights_ Obligations_ of_Investors. aspx

6. Guidance pertaining to special circumstances related to market activities: Default of Brokers

- (1) When a Broker defaults, the Exchange carries out the following steps for benefit of investor:

- Dissemination on Exchange website informing with regards to the default of the Broker

- Issue of Public Notice informing declaration of default by a Broker and inviting claims within specified period

- Intimation to clients of defaulter stock brokers via Emails and SMS for facilitating lodging of claims within specified period

- (2) Following information made available on Exchange Website for information of Investors:

- Norms for eligibility of claims for compensation from IPF.

- FAQ on processing of investors’ claims against Defaulter Broker

- Form for lodging claim against defaulter Broker

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers

- Provision to check online status of claims on Exchange Website

https:// www.bseindia. com/static /investors /Claim_ against_ Defaulter. aspx - (3) Standard Operating Procedure (SOP) for Handling of Claims of Investors in the Cases of Default by Stock Brokers

| Sr. No | Action | Timeline |

|---|---|---|

| Against Stock Brokers | ||

| 1 | Disablement of the Stock Broker | T day |

| 2 | Pre-filled forms to be sent to clients providing information regarding balances with the stock broker | T+30 days |

| 3 | Claim lodgement Clients to fill the claim form and provide the supporting documents |

Within 30 days of receipt of pre-filled form However, client can lodge claims till the end of 3 years from the date of the public notice provided |

| 4 | Processing of claims and auditing of claims |

Within 60 days of receipt of the claim form from the clients. |

| 5 | Declaration of stock broker as defaulter | Within 90 days from date of disablement (on account of triggering of SOP) (T+90 days) |

| 6 | Public Notice regarding declaration of defaulter | Within 3 working days from the date of declaration of defaulter |

| 7 | Approval of the claim (by IPF Trust on the basis of recommendation of MCSGFC and Intimation to the clients regarding admissibility of the claim and disbursal of the eligible amount | Within 15 days of declaration of default |

7. Dos and Don’ts - Advisory for Investors

- a) Do’s of Investing:

- b) Do’s for Grievance Redressal:

- c) Don’ts of Investing:

Please refer below link for above:

https:// www.bseindia. com/ static/investors /invdosdonot. aspx

Mission

- To provide transparent, equitable and reliable markets with timely and accurate information dissemination for investors.

- To provide the highest standards of investor education, investor awareness and investor protection and timely services.

Vision

- To provide a safe, equitable, transparent and trusted platform for investors to participate across asset classes with highest standards of integrity for investors.

Exchange provides various services to investors electronically through its online platform and physically through the dedicated investor service centers set for this purpose.

- Mode of filing the complaints

- Through SCORES (a web based centralized grievance redressal system of SEBI)

- Through Respective Exchange’s web portal dedicated for the filing of compliant

Click here to visit the portal - Email IDs

- Documents required for complaint resolution and Multi-level dispute resolution mechanism available at the Exchange.

Mechanism and Documents (.pdf) - Timelines for Complaint Resolution Process at Exchanges

Complaints can be lodged on the Exchange in the following ways:

a. Electronic mode

b. Offline mode – Physical Click here to download complaint form

| Sr. No | Type of Activity | Expected Timelines for activity |

|---|---|---|

| Against Stock Brokers | ||

| 1 | Receipt of Complaint | Day of complaint (C Day) |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker | C + 7 Working days |

| 3 | Registration of the Complaint and forwarding to the stock broker | C+8 Working Days i.e. T day |

| 4 | Amicable Resolution | T+15 Working Days |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution | T+16 Working Days |

| 6 | Complete resolution process post GRC | T + 30 Working Days |

| 7 | In case where the GRC Member requires additional information, complete resolution shall take place within | T + 45 Working Days |

| 8 | Implementation of GRC Order | On receipt of GRC Order, debit the funds of the stock broker |

| 9 | Complainant/ Broker, if not satisfied, by IGRC decision can avail arbitration mechanism | Within 3 months from the date of IGRC recommendation |

| 10 | In case of receipt of arbitration intention | Obtain an undertaking from the client and pay 50% of the award or 2 lakhs whichever is less to the client from the IPFT, in case GRC order is upto Rs. 20 lacs |

| 11 | Arbitration not filed within 3 months from the GRC Order | Obtain Undertaking from the client and Release 50% amount to the client. Replenish 50% amount to the IPF |

| 12 | Completion of arbitration proceedings | Within 4 months from the date of the final appointment of arbitrator |

| 13 | Completion of appellate proceedings | Within 3 months from the date of the final appointment of arbitrator |

| Against Companies | (Not Applicable for Commodities Markets) | |

| 1 | Complaint handling | |

| 1,1 | Complaint received in SCORES by the listed company | T day |

| 1.2 | Response to be obtained from Listed Company | T + 30 |

| 1.3 | If no response received, alert to Listed company in the form of reminder for Non - redressal of complaint | T+31 |

| 1.4 | Response to be obtained from Listed Company | T+60 |

-

When a Broker defaults, the Exchange carries out the following steps for benefit of investor:

- Dissemination on Exchange website informing with regards to the default of the Broker

- Issue of Public Notice informing declaration of default by a Broker and inviting claims within specified period

- Intimation to clients of defaulter stock brokers via Emails and SMS for facilitating lodging of claims within specified period

-

Following information made available on Exchange Website for information of Investors

- Norms for eligibility of claims for compensation from IPF.

- FAQ on processing of investors’ claims against Defaulter Broker

- Form for lodging claim against defaulter Broker

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers

- Provision to check online status of claims on Exchange Website

Read more...

- Standard Operating Procedure (SOP) for Handling of Claims of Investors in the Cases of Default by Stock Brokers

| Sr. No. | Action | Timeline |

|---|---|---|

|

|

Disablement of the Stock Broker | T day |

|

|

Pre-filled forms to be sent to clients providing information regarding balances with the stock broker | T+30 days |

|

|

Claim lodgement Clients to fill the claim form and provide the supporting documents | Within 30 days of receipt of pre-filled form However, client can lodge claims till the end of 3 years from the date of the public notice provided |

|

|

Processing of claims and auditing of claims | Within 60 days of receipt of the claim form from the clients. |

|

|

Declaration of stock broker as defaulter | Within 90 days from date of disablement (on account of triggering of SOP) (T+90 days) |

|

|

Public Notice regarding declaration of defaulter | Within 3 working days from the date of declaration of defaulter |

|

|

Approval of the claim (by IPF Trust on the basis of recommendation of MCSGFC and Intimation to the clients regarding admissibility of the claim and disbursal of the eligible amount | Within 15 days of declaration of default |

- Mission and Vision statement for Investors

- To provide transparent, equitable and reliable markets with timely and accurate information dissemination for investors.

- To provide the highest standards of investor education, investor awareness and investor protection and timely services.

- To provide a safe, equitable, transparent and trusted platform for investors to participate across asset classes with highest standards of integrity for investors.

- Business transacted by the exchange with respect to investors

- Services provided by the exchanges to investors

- Grievance redressal mechanism

- Mode of filing the complaints: Complaints can be lodged on the Exchange in the following ways:

- Through SCORES (a web based centralized grievance redressal system of SEBI) Click Here

- Through Respective Exchange’s web portal dedicated for the filing of compliant. Online Complaint Registration Form Click Here

- Emails (ig@ncdex.com/askus@ncdex.com)

- NCDEX Complaint Registration Form Click Here

- Documents required for complaint resolution and Multi-level dispute resolution mechanism available at the Exchange please refer to link. Mechanism and Documents required

-

Timelines for Complaint Resolution Process at Exchanges

Sr.No. Type of Activity Against Stock Brokers Expected Timelines for activity 1 Receipt of Complaint Day of complaint (C Day) 2 Additional information sought from the investor, if any, and provisionally forwarded to stock broker C + 7 Working days 3 Registration of the Complaint and forwarding to the stock broker C+8 Working Days i.e. T day 4 Amicable Resolution T+15 Working Days 5 Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution T+16 Working Days 6 Complete resolution process post GRC T + 30 Working Days 7 In case where the GRC Member requires additional information, complete resolution shall take place within T + 45 Working Days 8 Implementation of GRC Order On receipt of GRC Order, debit the funds of the stock broker 9 Complainant/ Broker, if not satisfied, by IGRC decision can avail arbitration mechanism Within 6 months from the date of IGRC recommendation 10 In case of receipt of arbitration intention Obtain an undertaking from the client and pay 50% of the award or 2 lakhs whichever is less to the client from the IPFT, in case GRC order is upto Rs. 20 lacs 11 Arbitration not filed within 6 months from the GRC Order Obtain Undertaking from the client and Release 50% amount to the client. Replenish 50% amount to the IPF 12 Completion of arbitration proceedings Within 4 months from the date of the final appointment of arbitrator 13 Completion of appellate proceedings Within 3 months from the date of the final appointment of arbitrator - Rights and Obligations of investors:

- Rights of Investors Click Here

- Obligations of Investors Click Here

- Guidance pertaining to special circumstances related to market activities: Default of Brokers/ Members

- When a Trading Member defaults, the Exchange carries out the following steps for benefit of investor:

- Dissemination on Exchange website informing with regards to the default of the trading member

- Issue of Public Notice informing declaration of default by a Member and inviting claims within specified period

- Intimation to clients of defaulter stock brokers/ trading members via Emails and SMS for facilitating lodging of claims within specified period

- Following information made available on Exchange Website for information of Investors

- Norms for eligibility of claims for compensation from IPF.

- FAQ on processing of investors’ claims against Defaulter Broker

- Form for lodging claim against defaulter Broker

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers. Read More Click Here

-

Standard Operating Procedure (SOP) for Handling of Claims of Investors in the Cases of Default by Stock Brokers/Members

Sr.No. Action Timeline 1 Disablement of the Stock Broker T day 2 Pre-filled forms to be sent to clients providing information regarding balances with the stock broker T+30 days 3 Claim lodgement, Clients to fill the claim form and provide the supporting documents Within 30 days of receipt of pre-filled form. However, client can lodge claims till the end of 3 years from the date of the public notice provided 4 Processing of claims and auditing of claims Within 60 days of receipt of the claim form from the clients. 5 Declaration of stock broker as defaulter Within 90 days from date of disablement (on account of triggering of SOP)

(T+90 days)6 Public Notice regarding declaration of defaulter Within 3 working days from the date of declaration of defaulter 7 Approval of the claim (by IPF Trust on the basis of recommendation of MCSGFC and Intimation to the clients regarding admissibility of the claim and disbursal of the eligible amount Within 15 days of declaration of default - Dos and Don’ts - Advisory for Investors

- Dos of Investing Click Here

- Dos for Grievance Redressal Click Here

- Donts of Investing Click Here

Mission

Vision

The Exchange facilitates various products for investors to participate across Commodity Derivatives viz Futures and Options in agricultural and non-agricultural commodities and Indices. Read more

Exchange provides various services to investors electronically through its online platform and physically through the dedicated investor service centers set for this purpose.

Services provided by the Exchange to investors Click Here

(a)Electronic mode -

(b)Offline mode – Physical-

Mission

- To provide transparent, equitable and reliable markets with timely and accurate information dissemination for investors.

- To provide the highest standards of investor education, investor awareness and investor protection and timely services.

Vision

To provide a safe, equitable, transparent and trusted platform for investors to participate across asset classes with highest standards of integrity for investors.

The exchange facilitates various products for investors to participate across asset classes viz Commodity Derivatives, Futures, Options and Indices. Details available on the link https:// www.mcxindia. com/products/

Exchange provides various services to investors electronically through its online platform and physically through the dedicated investor service centers set for this purpose. Details available on the link. Click Here

- Mode of filing the complaints: Complaints can be lodged on the Exchange in the following ways:

- (a) Electronic mode -

- (i) Through SCORES (a web based centralized grievance redressal system of SEBI) https:// scores.gov. in/ scores/ Welcome. html

- (ii) Through Respective Exchange’s web portal dedicated for the filing of complaint https:// igrs. mcxindia. com/

- (iii) Email IDs https:// www.mcxindia. com/ Investor- Services/ grievances/ contact-us

- (b) Offline mode – Physical- https:// www.mcxindia. com/Investor- Services/ grievances/ client- complaint- form

- Regarding documents required for complaint resolution and Multi-level dispute resolution mechanism available at the Exchange.

- (a) Documents required for complaint resolution:

- Complete Account Opening Kit

- Contract notes

- Ledger statement

- Bank statement

- Demat transaction statement

- Any other document in support of claim

- (b) Multi-level dispute resolution mechanism available at the Exchange:

- Amicable resolution at Exchange level

- If no amicable resolution arrived at, matter is referred to Investor Grievance Redressal Committee who are independent entities set up for the compliant resolution.

- Arbitration proceedings

- Appellate Arbitration proceedings

- Timelines for Complaint Resolution Process at Exchanges

| Sr. No | Type of Activity | Expected Timelines for activity |

|---|---|---|

| Against Stock Brokers | ||

| 1. | Receipt of Complaint | Day of complaint (C Day) |

| 2. | Additional information sought from the investor, if any, and provisionally forwarded to stock broker | C + 7 Working days |

| 3. | Registration of the Complaint and forwarding to the stock broker | C+8 Working Days i.e. T day |

| 4. | Amicable Resolution | T+15 Working Days |

| 5. | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution | T+16 Working Days |

| 6. | Complete resolution process post GRC | T + 30 Working Days |

| 7. | In case where the GRC Member requires additional information, complete resolution shall take place within | T + 45 Working Days |

| 8. | Implementation of GRC Order | On receipt of GRC Order, debit the funds of the stock broker |

| 9. | Complainant/ Broker, if not satisfied, by IGRC decision can avail arbitration mechanism | Within 6 months from the date of IGRC recommendation |

| 10. | In case of receipt of arbitration intention | Obtain an undertaking from the client and pay 50% of the award or 2 lakhs whichever is less to the client from the IPFT, in case GRC order is upto Rs. 20 lacs |

| 11. | Arbitration not filed within 6 months from the GRC Order | Obtain Undertaking from the client and Release 50% amount to the client. Replenish 50% amount to the IPF |

| 12. | Completion of arbitration proceedings | Within 4 months from the date of the final appointment of arbitrator |

| 13. | Completion of appellate proceedings | Within 3 months from the date of the final appointment of arbitrator |

- When a Broker defaults, the Exchange carries out the following steps for benefit of investor:

- Dissemination on Exchange website informing with regards to the default of the Broker

- Issue of Public Notice informing declaration of default by a Broker and inviting claims within specified period

- Intimation to clients of defaulter stock brokers via Emails and SMS for facilitating lodging of claims within specified period

- Following information made available on Exchange Website for information of Investors:

- Norms for eligibility of claims for compensation from IPF.

- FAQ on processing of investors’ claims against Defaulter Broker - https:// www.mcxindia. com/Investor- Services/ defaulters/ sop process faqs for handling of claims of investors of defaulter member

- Form for lodging claim against defaulter Broker - https:// www.mcxindia. com/Investor Services/ defaulters/ register claim against defaulter expelled members

- Provision to check online status of claims on Exchange Website - https:// igrs.mcxindia. com/

- Standard Operating Procedure (SOP) for Handling of Claims of Investors in the Cases of Default by Stock Brokers.

| Sr. No. | Action | Timeline |

|---|---|---|

| 1. | Disablement of the Stock Broker | T day |

| 2. | Pre-filled forms to be sent to clients providing information regarding balances with the stock broker | T+30 days |

| 3. | Claim lodgement Clients to fill the claim form and provide the supporting documents | Within 30 days of receipt of pre-filled form. However, client can lodge claims till the end of 3 years from the date of the public notice provided |

| 4. | Processing of claims and auditing of claims | Within 60 days of receipt of the claim form from the clients. |

| 5. | Declaration of stock broker as defaulter | Within 90 days from date of disablement (on account of triggering of SOP) (T+90 days) |

| 6. | Public Notice regarding declaration of defaulter | Within 3 working days from the date of declaration of defaulter |

| 7. | Approval of the claim (by IPF Trust on the basis of recommendation of MCSGFC and Intimation to the clients regarding admissibility of the claim and disbursal of the eligible amount | Within 15 days of declaration of default |

- Mission and Vision sta tement for Investors

- To provide transparent, equitable and reliable markets with timely and accurate information dissemination for investors.

- To provide the highest standards of investor education, investor awareness and investor protection and timely services.

- Business transacted by the exchange w.r.t investors The exchange facilitates various products for investors to participate across asset Classes viz Equity, Derivatives, Debt, Mutual Funds, Government securities etc. Details available on the https:// www.msei.in /products /default

- Services provided by the exchanges to investors Exchange provides various services to investors electronically through its online platform and physically through the dedicated investor service centers set for this purpose. Details available on the link https:// www.msei.in /Investors/ Introduction; https:// www.msei.in/ Corporates/ Corporate Securities Information /Suspended Companies

-

Grievance redressal mechanism

(1) Mode of filing the complaints: Complaints can be lodged on the Exchange in the following ways:

-

a). Electronic mode-

- Through SCORES (a web based centralized grievance redressal system of SEBI) https:// scores.gov.in /scores/ Welcome. html

- Through Respective Exchange's web portal dedicated for the filing of Compliant link https:// www.msei.in/ Investors/ Introduction

- Emails : Investorcomplaints @msei.in

- b). Offline mode-Physical- https:// www.msei.in /Investors /Introduction

- Timelines for complaint resolution process at Stock Exchanges against stock brokers

- Rights and Obligations of investors:

- For rights please refer to the link https:// www.msei.in /Investors /Introduction

- For obligations please refer to the link https:// www.msei.in /Investors /Introduction

- Guidance pertaining to special circumstances related to market activities: Default of Brokers

- When a Broker defaults, the Exchange carries out the following steps for benefit of investor:

- Dissemination on Exchange website informing with regards to the default of the Broker

- Issue of Public Notice informing declaration of default by a Broker and inviting claims within specified period

- Intimation to clients of defaulter stock brokers via Emails and SMS for facilitating lodging of claims within specified period

- Following information made available on Exchange Website for information of Investors https:// www.msei. in/Investors //Defaulter _Claims

- Norms for eligibility of claims for compensation from IPF.

- FAQ on processing of investors' claims against Defaulter Broke

- Form for lodging claim against defaulter Broker

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers

- Provision to check online status of claims on Exchange Website

- Standard Operating Procedure (SOP) for handling of claims of the Investors in the Cases of Default by Stock Brokers.

- Dos and Don'ts - Advisory for Investors

- Do's of Investing: Please refer to the link https: //www.msei. in/Investors /Introduction

- Do's for Grievance Redressal: Please refer to the link https:// www.msei. in/Investors /Introduction

- Don'ts of Investing: Please refer to the link https:// www.msei. in/Investors /Introduction

Mission

Vision

To provide a safe, equitable, transparent and trusted platform for investors to participate across asset classes with highest standards of integrity for investors.

(2) Regarding documents required for complaint resolution and Multi-level dispute resolution mechanism available at the Exchange please refer to link https:// www.msei.in /Investors /Introduction

| Sr.No. | Type of Activity | Timelines for activity |

|---|---|---|

| Against Stock Broker | ||

| 1 | Receipt of Complaint | Day of Complaint (C Day) |

| 2 | Additional information sought from the investor, if any, and provisionally forwarded to stock broker | C+7 working days |

| 3 | Registration of the Complaint and forwarding to Stock broker | C+8 working days i.e., T day |

| 4 | Amicable resolution | T+15 working days |

| 5 | Refer to Grievance Redressal Committee (GRC), in case of no amicable resolution. | T+16 working days |

| 6 | Complete resolution process post GRC | T+30 working days |

| 7 | In case where the GRC members requires additional information, Complete resolution shall take place within | T+45 working days |

| 8 | Implementation of GRC order | On receipt of GRC order, debit the funds of stock broker |

| 9 | Complainant/broker, if not satisfied by IGRC decision can avail arbitration mechanism | Within 6 months from the date of IGRC recommendation |

| 10 | In case of receipt of arbitration intention | Obtain an undertaken from the client and pay 50% of the award or 2 lakhs whichever is less to the client from IPFT, In case GRC order is upto 20 lakhs |

| 11 | Arbitration not filed within 6 months from the GRC order | Obtain an undertaken from the client and release 50% amount to the client Replenish 50% amount to the IPF |

| 12 | Completion of Arbitration proceedings | Within 4 months from the date of the final appointment of arbitrator |

| 13 | Completion of appellate proceedings | Within 3 months from the date of the final appointment of arbitrator |

| Against Companies | (Not Applicable for Commodities Markets) | |

| 1 | Complaints handling | |

| 1.1 | Complaint received in SCORES by the listed company | T day |

| 1.2 | Response to be obtained from listed company | T + 30 |

| 1.3 | If no response received, alert to listed company in the form of reminder for non-redressal of complaint | T + 31 |

| 1.4 | Response to be obtained from listed company | T + 60 |

| Sr. no. | Action | Timeline |

|---|---|---|

| 1 | Disablement of Stock broker | T day |

| 2 | Pre-filled form to be sent to clients providing information regarding balances with the stock broker | T+ 30 days |

| 3 | Claim lodgment Client to fill the claim form and provide the supporting documents |

Within 30 days of receipt of prefilled form However, client can lodge claim till the end of 3 years from the date of public notice provided. |

| 4 | Processing of claim and auditing of claim | Within 60 days of receipt of the claim form from the clients |

| 5 | Declaration of Stock broker as defaulter | Within 90 days from date of disablement( on account of triggering of SOP) (T+ 90 days) |

| 6 | Public notice regarding the defaulter | Within 3 working days from the date of declaration of defaulter |

| 7 | Approval of the claim (by IPF trust on the basis of recommendation of MCSGFC and intimation to the clients regarding admissibility of the claim and disbursal of the eligibility amount | Within 15 days of declaration of default |

Investor Charter of Depositories

1. Vision

- Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

2. Mission

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

3. Details of business transacted by the Depository and Depository Participant (DP)

- A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available in the link https://nsdl.co.in/dpsch.php

4. Description of services provided by the Depository through Depository Participants (DP) to investors

(1) Basic Services

| Sr. No. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion / Destatementization | 5 days |

| 4 | Re-conversion / Restatementisation of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of demat account | 30 days |

| 8 | Settlement Instruction | Depositories to accept physical DIS for pay-in of securities upto 4 p.m. and DIS in electronic form upto 6 p.m. on T+1 day |

(2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr. No. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services |

Depositories also provide value added services such as

|

| 2 | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly (if no transactions). |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: |

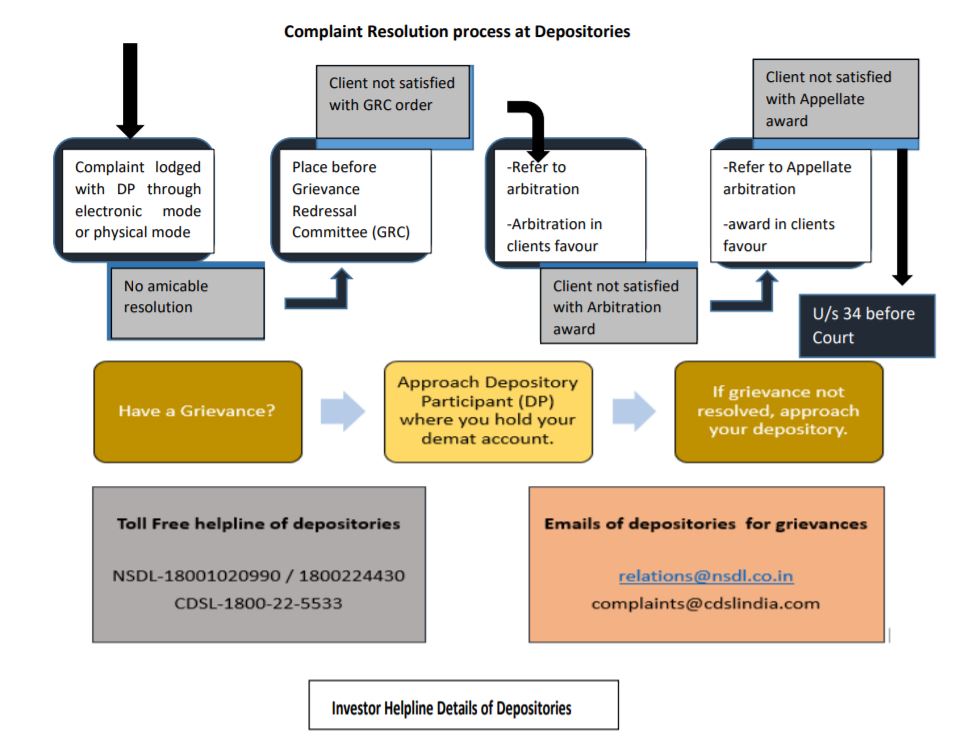

5. Details of Grievance Redressal Mechanism

(1) The Process of investor grievance redressal

| 1 | Investor Complaint/ Grievances |

Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

|

| 2 | Investor Grievance Redressal Committee of Depository | If no amicable resolution is arrived, then the Investor has the option to refer the complaint/ grievance to the Grievance Redressal Committee (GRC) of the Depository. Upon receipt of reference, the GRC will endeavor to resolve the complaint/ grievance by hearing the parties, and examining the necessary information and documents. |

| 3 | Arbitration proceedings | The Investor may also avail the arbitration mechanism set out in the Byelaws and Business Rules/Operating Instructions of the Depository in relation to any grievance, or dispute relating to depository services. The arbitration reference shall be concluded by way of issue of an arbitral award within 4 months from the date of appointment of arbitrator(s). |

(2)For the Multi-level complaint resolution mechanism available at the Depositories

6. Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

| Sr. No. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 |

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

7. Dos and Don’ts for Investors

Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the linkhttps://www.cdslindia.com/DP/dplist.aspx

(1) Basic Services

| Sr. No. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion / Destatementization | 5 days |

| 4 | Re-conversion / Restatementisation of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of demat account | 30 days |

| 8 | Settlement Instruction | Depositories to accept physical DIS for pay-in of securities upto 4 p.m and DIS in electronic form upto 6 p.m on T+1 day |

(2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr. No. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services | Depositories also provide value added services such as a. Basic Services Demat Account (BSDA) b. Transposition cum dematerialization c. Linkages with Clearing System d. Distribution of cash and non-cash corporate benefits (Bonus, Rights, IPOs etc.), stock lending. |

| 2 | Consolidated Account statement (CAS) |

CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly(if no transactions) . |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: a. E-account opening b. Online instructions for execution c. e-DIS / Demat Gateway d. e-CAS facility e. Miscellaneous services |

(1) The Process of investor grievance redressal

| 1 | Investor Complaint/ Grievances |

Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

a. Electronic mode -

(i) SCORES (a web based centralized grievance redressal system of SEBI) (ii) Respective Depository’s web portal dedicated for the filing of compliant (iii) Emails to designated email IDs of Depository - complaints@cdslindia.com

b. Offline mode :

For tracking of your grievance, we request you to submit the same online through the portal. |

| 2 | Registration of matters for Online Dispute Resolution (ODR) [Conciliation/ Arbitration w.e.f. August 16, 2023] | Click here |

| 3 | Investor Grievance Redressal Committee of Depository | Click here |

| 4 | Arbitration proceedings | Click here |

(2) For the Multi-level complaint resolution mechanism available at the Depositories please refer to link Complaint Resolution process at Depositories

| Sr. No. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 |

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

For Do’s and Don’ts please refer to the link Dos and Don’ts for Investor

For rights please refer to the link Rights of investors

For responsibilities please refer to the link Responsibilities of Investors