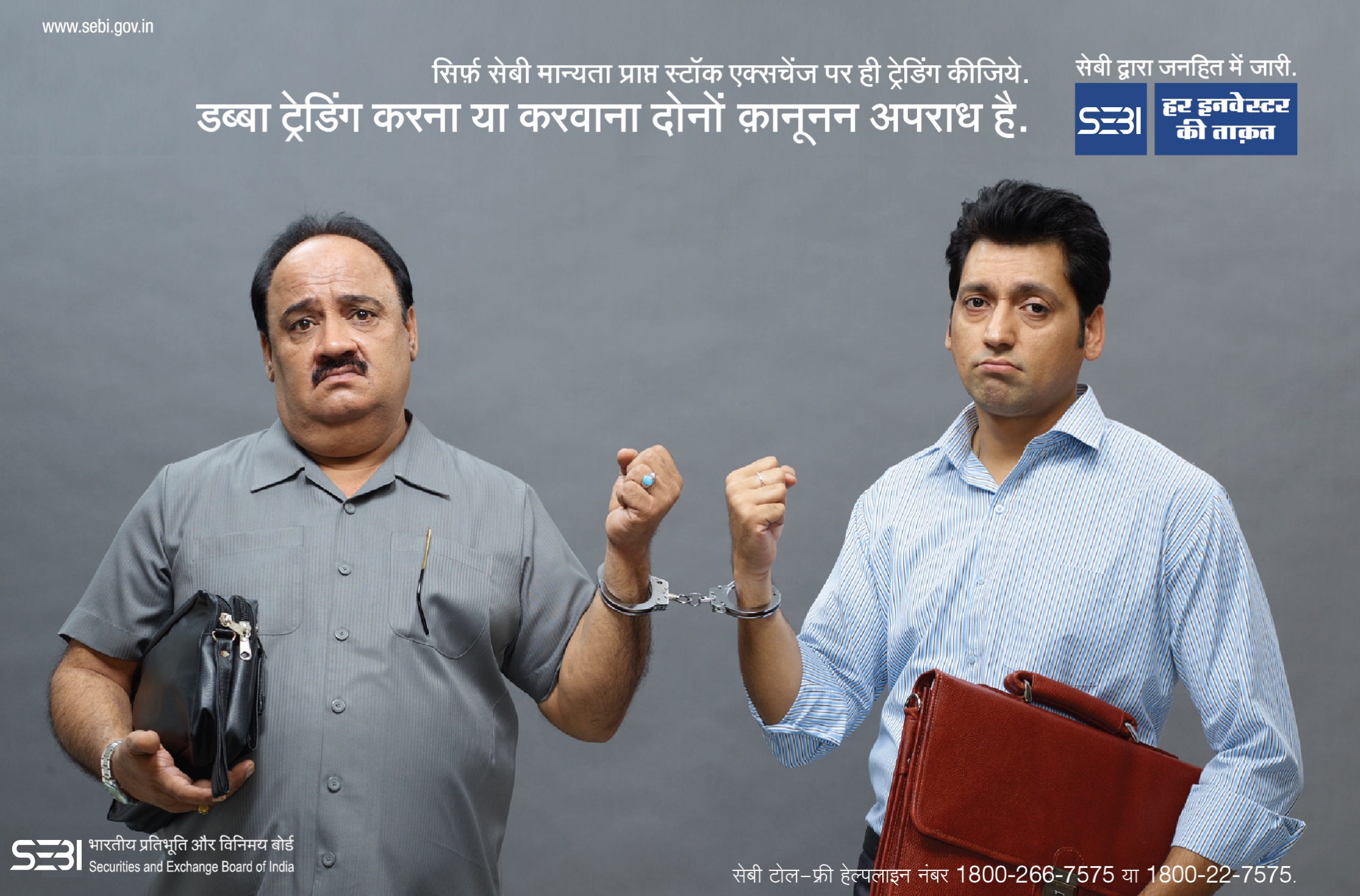

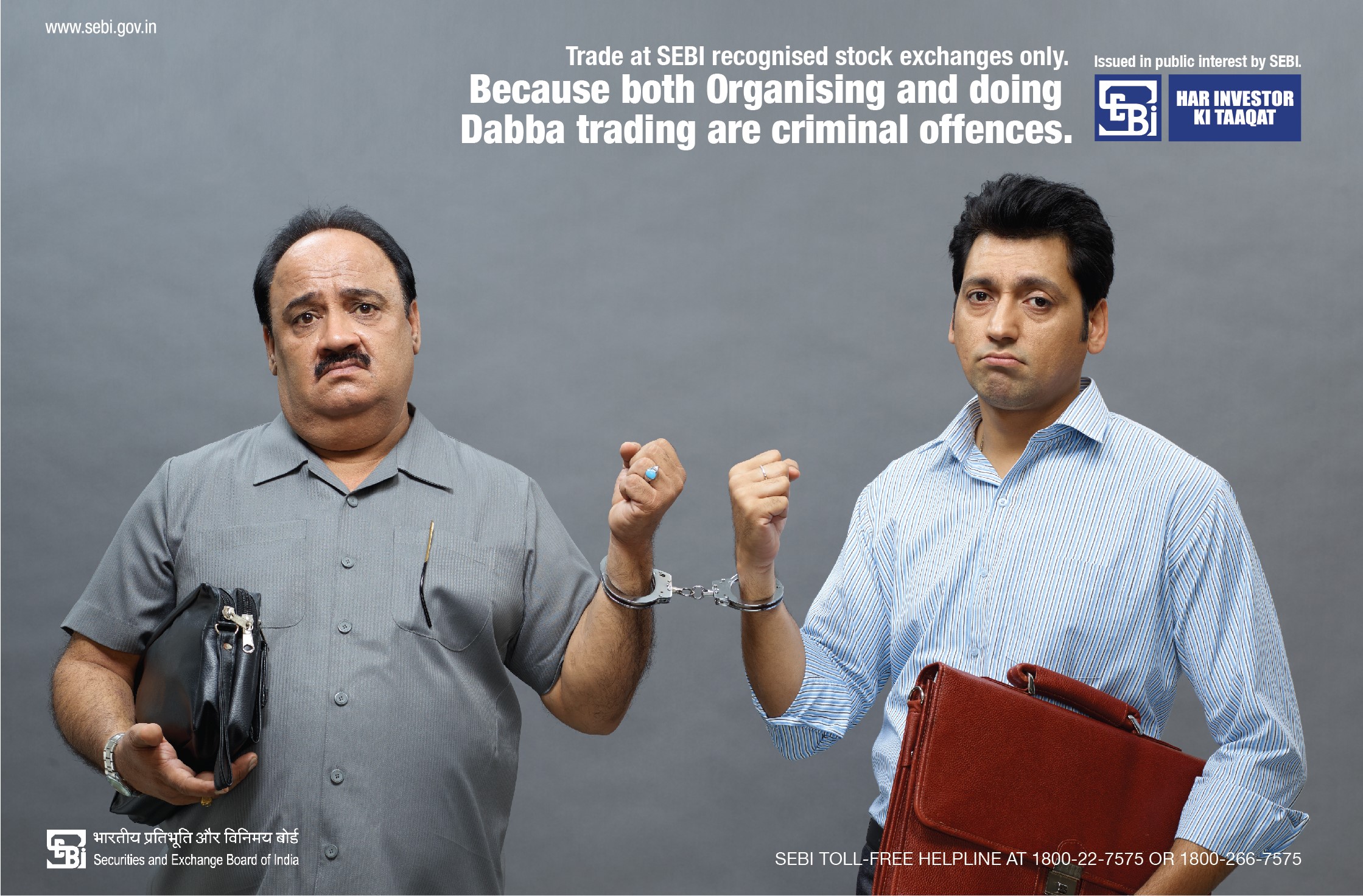

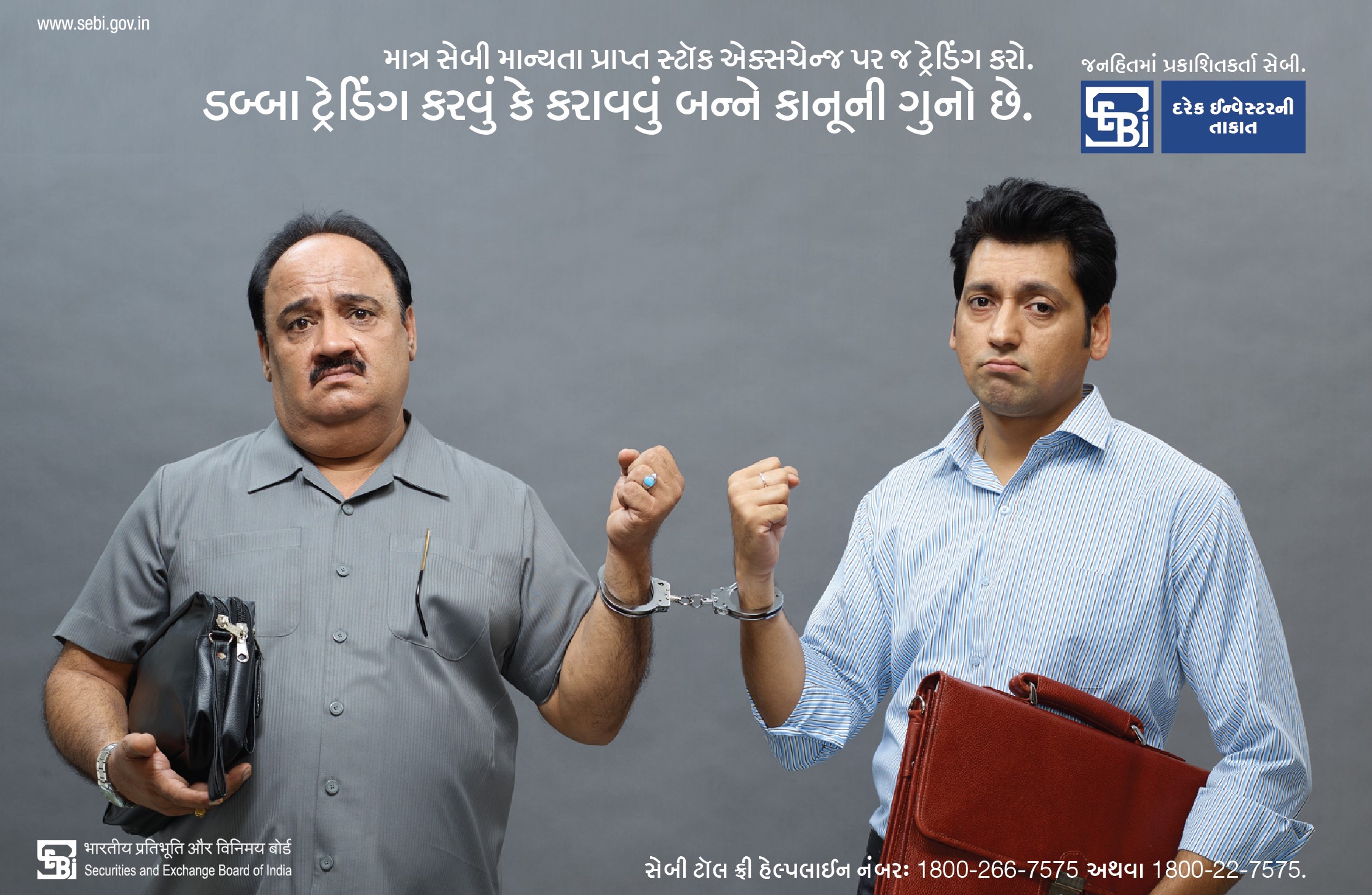

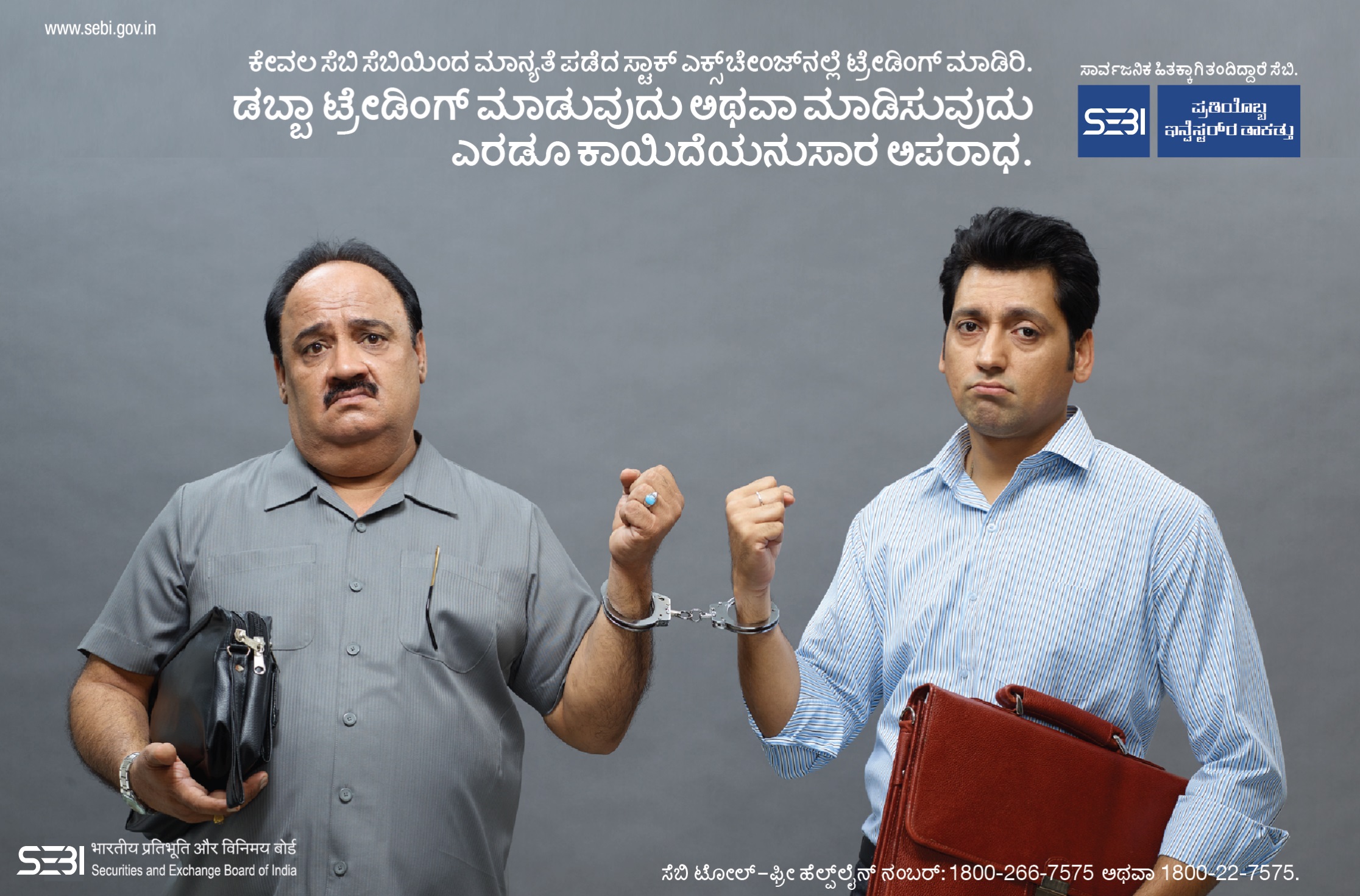

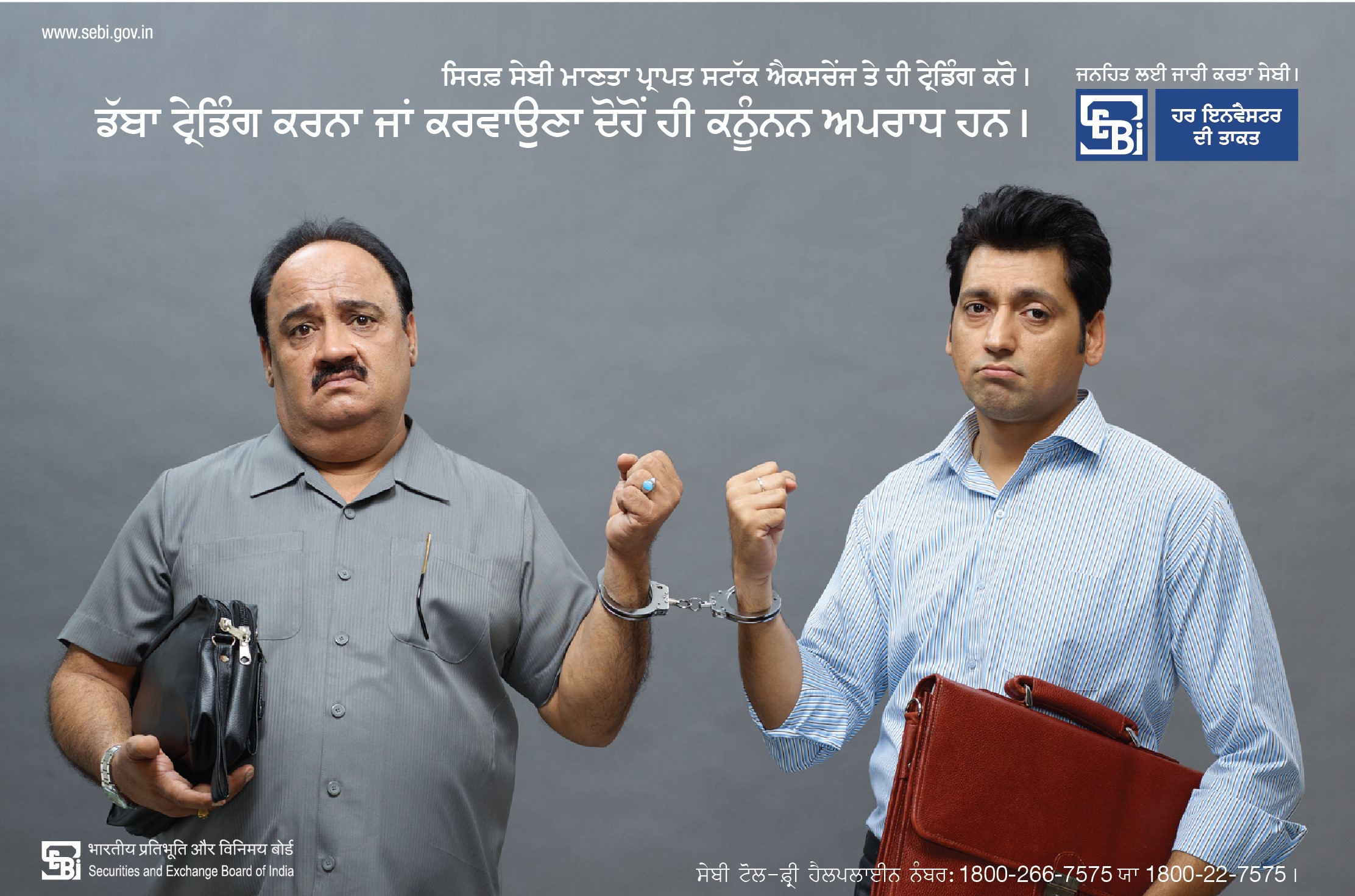

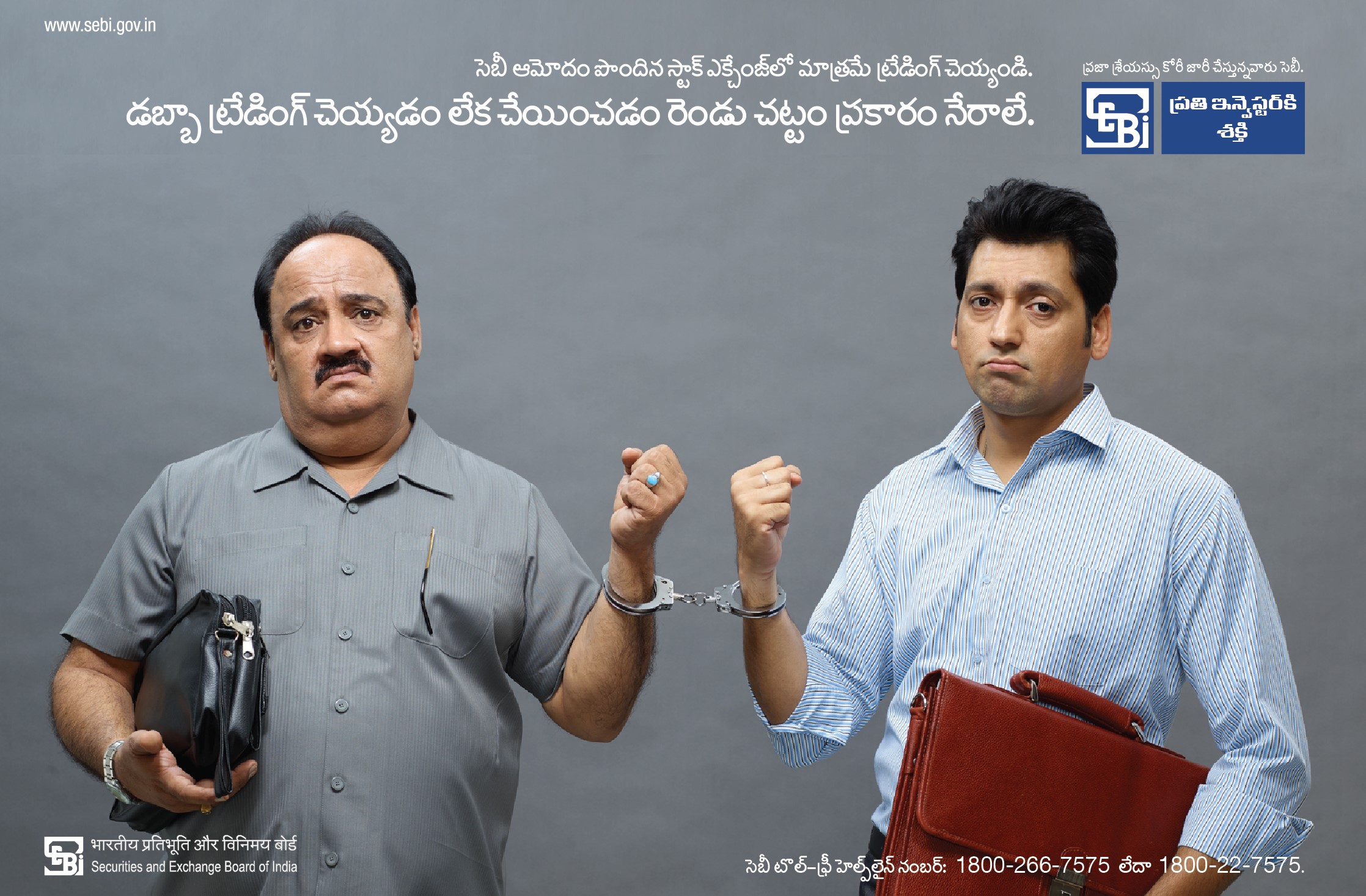

Dabba Trading

Dabba trading is an illegal and unregulated form of trading. In dabba trading, traders place deals in securities without the trades actually being executed on any official SEBI recognized stock exchange. These trades are settled internally by the dabba operator and are outside the purview of stock exchanges and regulatory bodies. Since these trades are not executed on official stock exchange platforms, investors can not avail grievances redressal mechanism of stock exchanges. Therefore, investor should exercise caution and should not indulge any form of dabba trading

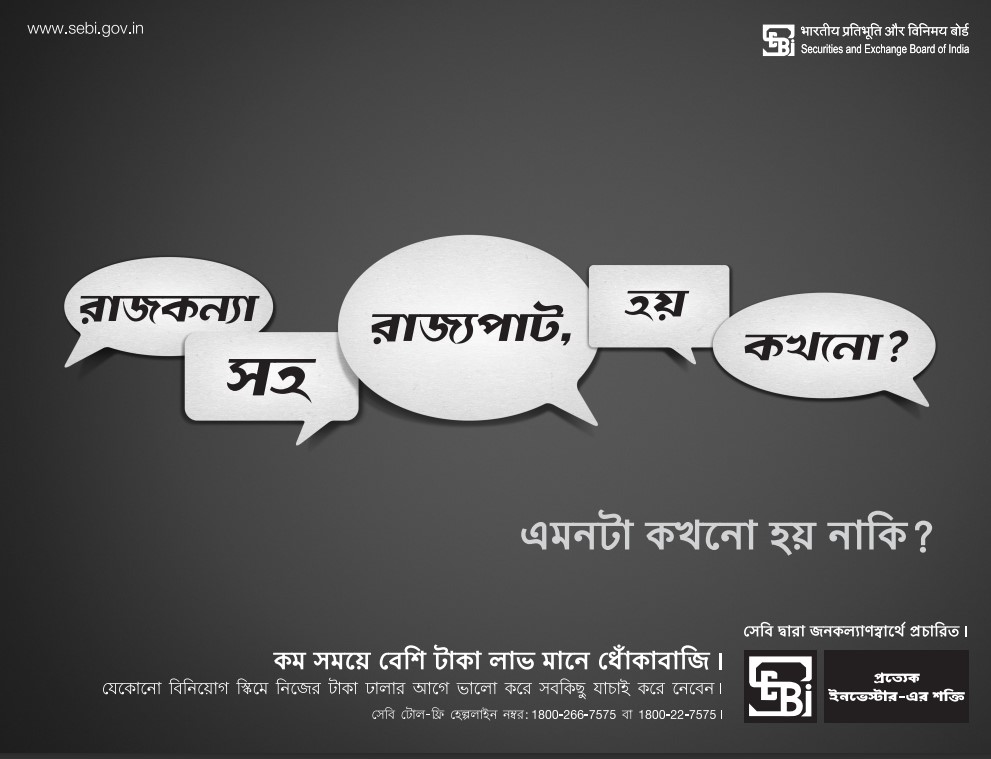

Collective Investment Scheme Hearsay

This message is cautioning against the allure of high returns in a short amount of time, as this can lead to trouble. Investments or opportunities promising unrealistically high returns can be indicators of investment scams, get-rich-quick schemes, or other fraudulent activities. It's essential for individuals to thoroughly research and understand the risk. Further, investor can seek Investment advice from SEBI registered Investment Advisor, and be wary of any offers that sound too good to be true.

SEBI Grievance Redressal (SCORES)

In case of any complaint related to the securities market, you may first approach the concerned intermediary or company. The concerned intermediary or company will facilitate the complaint redressal. In case the grievance remains unresolved, you may approach the concerned Stock, Exchange or Depository against your stock broker or listed company. If you are still not satisfied with the redressal, you may lodge a complaint with SEBI through a web based centralized grievance redressal called SCORES (SEBI Complaints Redress System).

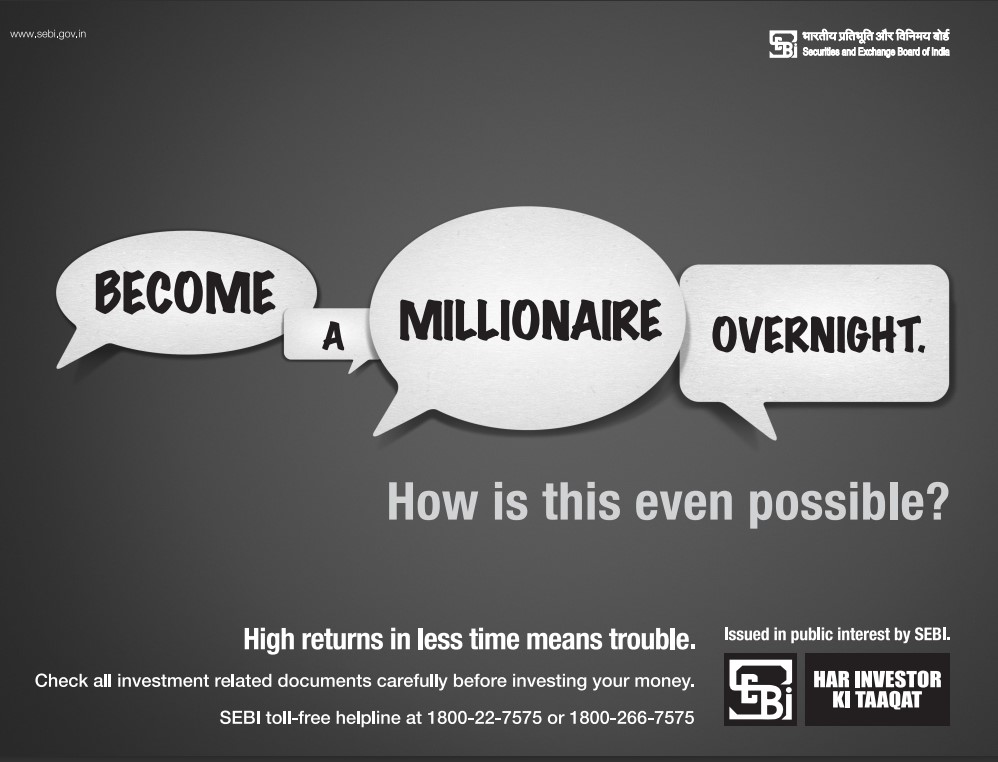

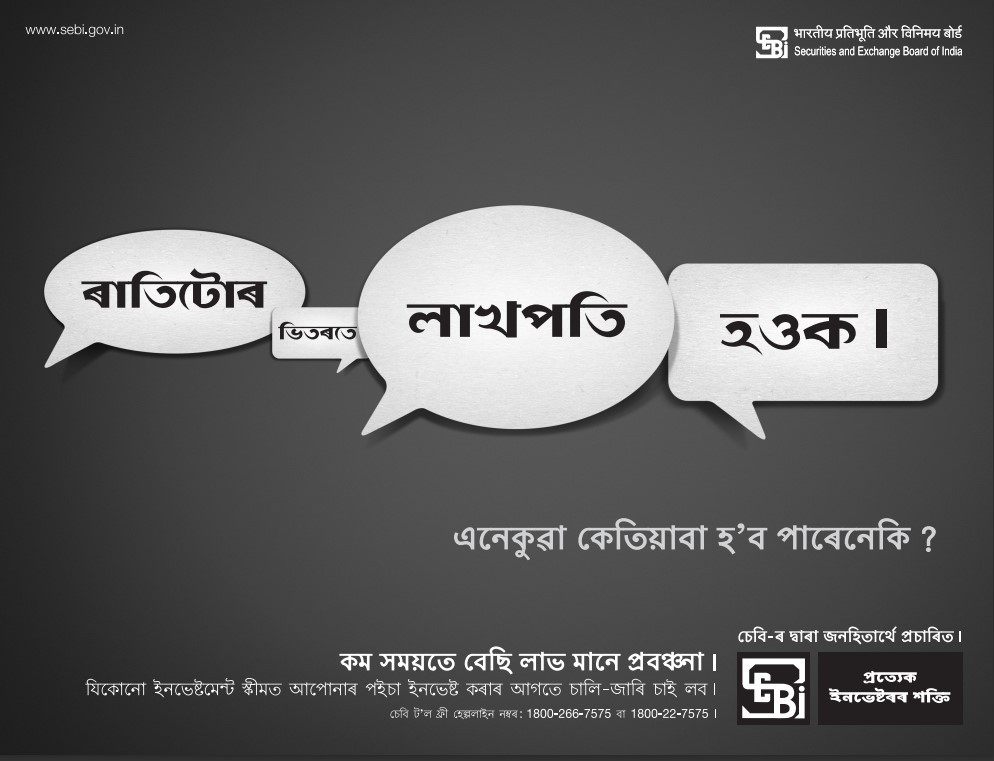

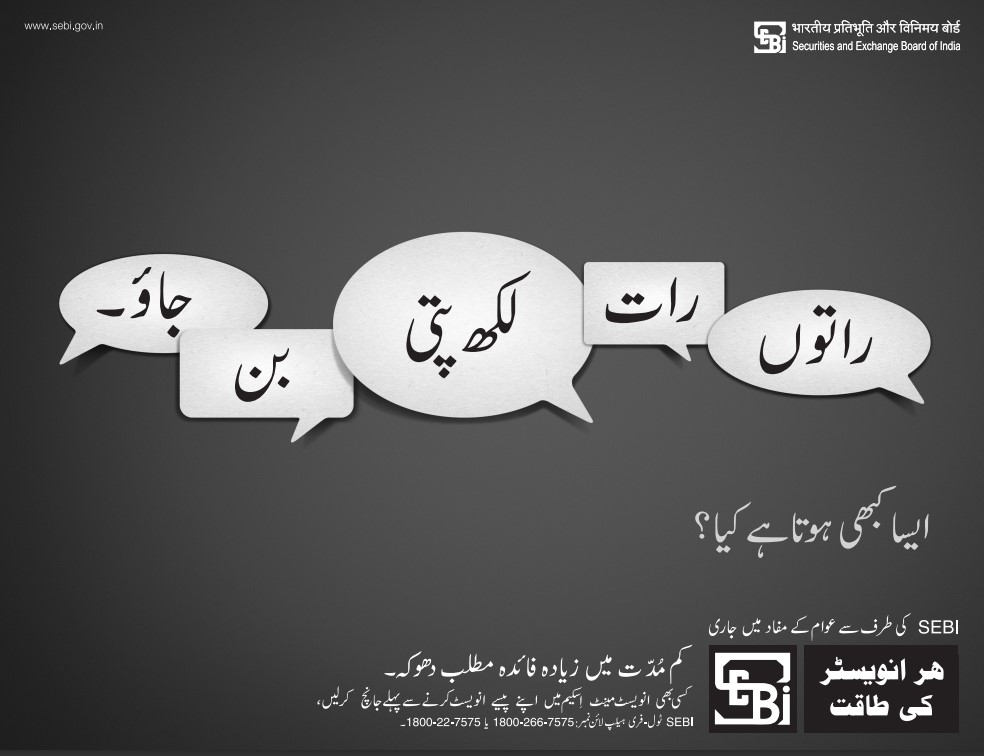

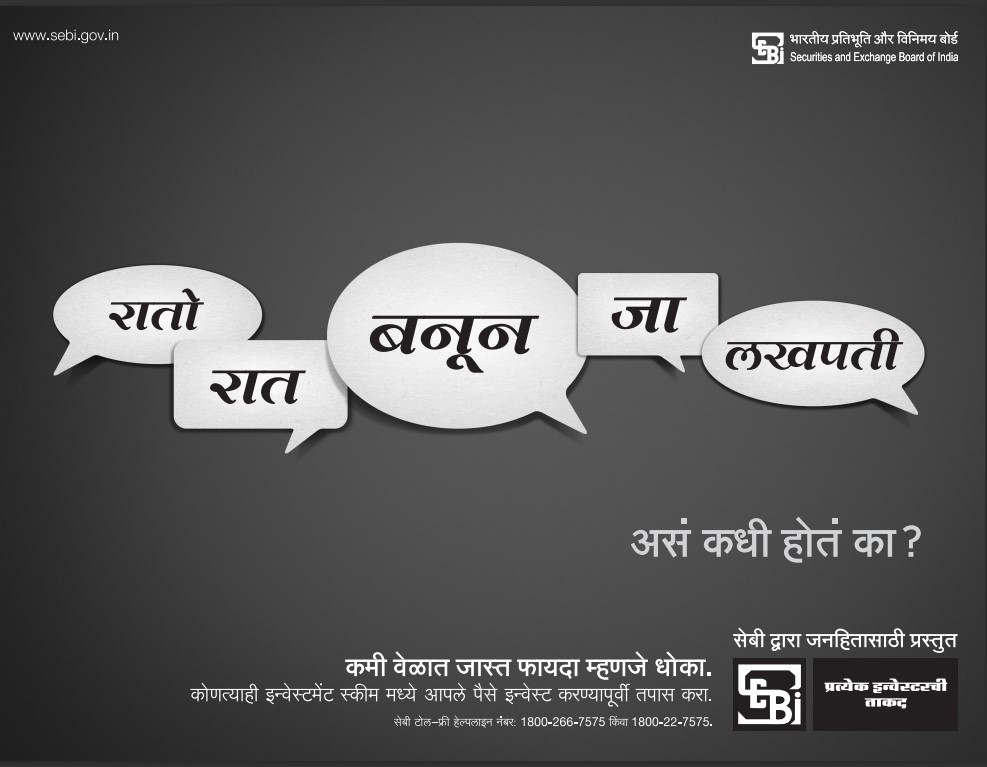

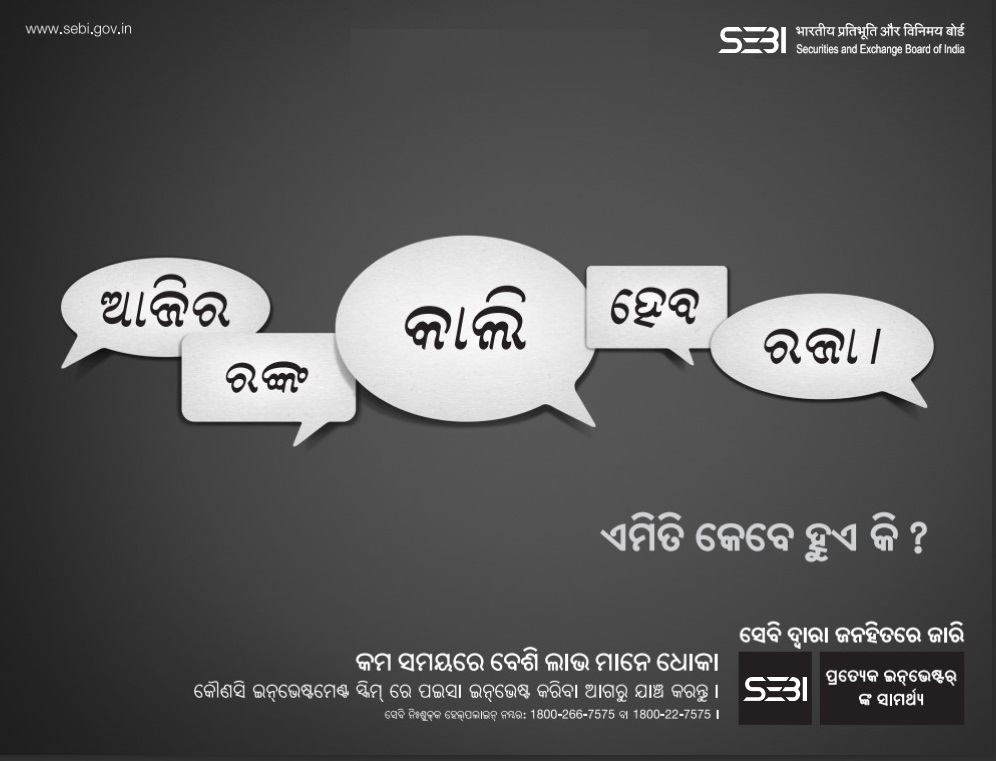

Caution Against Unrealistic Returns

The message is cautioning against the allure of high returns in a short amount of time, as this can lead to trouble. Investments or opportunities promising unrealistically high returns can be indicators of investment scams, get-rich-quick schemes, or other fraudulent activities. It's essential for individuals to thoroughly research and understand the risk. Further, investor can seek Investment advice from SEBI registered Investment Advisor, and be wary of any offers that sound too good to be true.

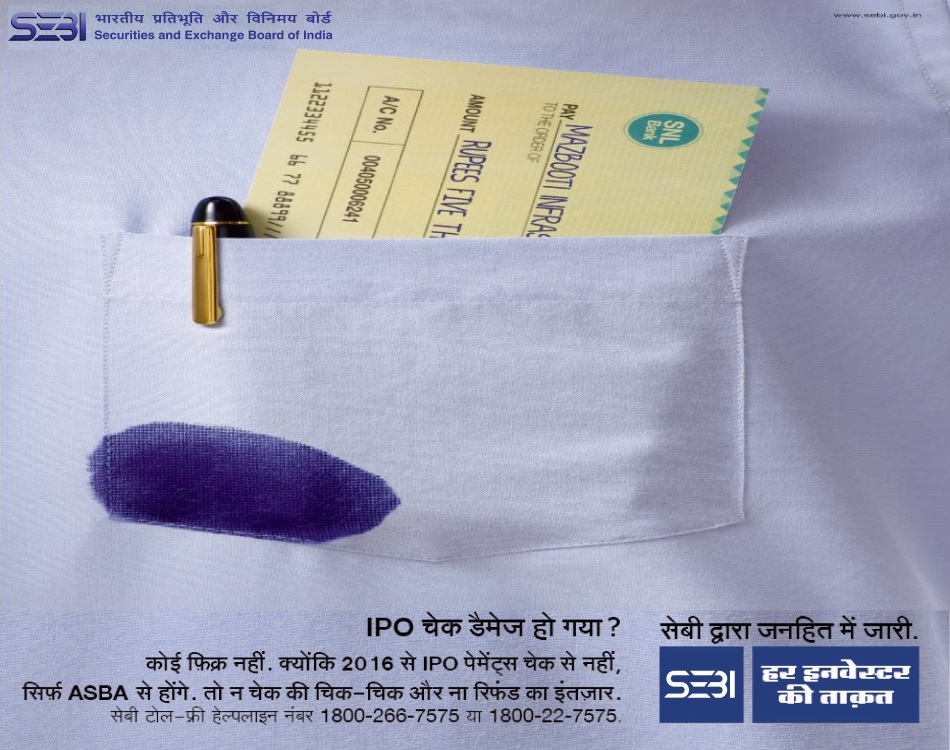

Say Goodbye to Physical cheques with ASBA

Traditionally, investors were required to issue physical cheques as a means of payment when subscribing to Initial Public Offers (IPOs). This process often entailed complex paperwork and potential delays. However, the Applications Supported by Blocked Amount (ASBA) facility has revolutionized this procedure. Now, investors can seamlessly participate in IPOs without the hassle of issuing physical cheques.