Caution to Investor

Caution Against Ponzi Schemes

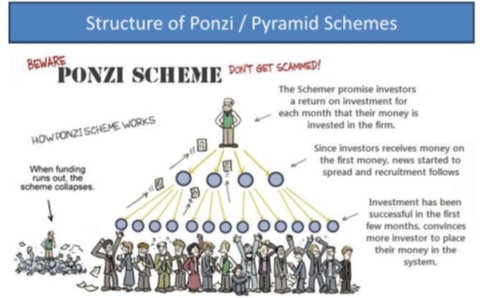

A Ponzi scheme is a fraudulent investment scheme promising high rates of return to investors. The scheme generates returns for earlier investors from their own money or money paid by subsequent investors, rather than any actual profit earned. The perpetuation of the returns that a Ponzi scheme advertises and pays requires an ever-increasing flow of money from investors to keep the scheme going.

The Ponzi scheme usually attract new investors by offering returns that other investments cannot guarantee, in the form of short-term returns that are either abnormally high or unusually consistent. As more investors become involved, the likelihood of the scheme coming to the attention of authorities increases. It has been the typical experience that promoter then vanishes, taking all the remaining investors' money. Such schemes typically collapse under their own weight as fresh investments slow down and the promoter starts having problems paying the promised returns.

The system is destined to collapse because the earnings, if any, are less than the payments to investors. Sometimes, the authorities are able to clamp down on such schemes before they collapse because they act on suspicion of a scheme being a Ponzi scheme.

Here are few tips that help you to spot a Ponzi Scheme

High returns with little or no risk: - Every investment carries some degree of risk. Higher the return, higher is the risk involved. Be highly suspicious of any guaranteed high return investment opportunity.

Overly consistent returns: - Investments tend to go up and down over time. Be sceptical about an investment that regularly gives positive returns regardless of overall market conditions.

Unregistered investments: - Ponzi schemes typically involve investment schemes that are not registered with the regulators or any government agency for their activity. Registration is important because it provides investors with access to information about the company's management, products, services and finances.

Unlicensed sellers: - Any investment scheme requires to be registered with concerned authority and state securities laws require investment professionals and firms to be licensed or registered. Most Ponzi schemes involve unlicensed individuals or unregistered firms.

Non-transparent disclosure: - Avoid investments if you don't understand them or can't get complete information about them. Account statement errors may be a sign that funds are not being invested as promised.

Difficulty in receiving payments: - Be suspicious if you don't receive a payment or have difficulty cashing out. Ponzi scheme promoters sometimes try to prevent participants from cashing out by offering even higher returns for staying invested.

Caution against Unregistered Investment Advisers

SEBI registers Investment Advisers under SEBI (Investment Advisers) Regulations, 2013. An "Investment Adviser" is any person, who for consideration, is engaged in the business of providing investment advice to clients or other persons or group of persons and includes any person who holds out himself as an investment adviser, by whatever name called.

The aim of the Regulation is to regulate "investment advice" which refers to advice relating to investing in, purchasing, selling or otherwise dealing in securities or investment products, and advice on investment portfolio containing securities or investment products, whether written, verbal or through any other means of communication for the benefit of the client and shall include financial planning: Provided that investment advice given through newspaper, magazines, any electronic or broadcasting or telecommunications medium, which is widely available to the public shall not be considered as investment advice for the purpose of these regulations. Investment Advisers are required to obtain registration from SEBI and follow the Code of Conduct.

It is illegal to act as Investment Adviser without SEBI registration. SEBI is making concerted efforts to stop such illegal activities. Some unscrupulous and ignorant entities may not get themselves registered and, or, may not follow the Code of Conduct. Investment Advisers have to limit themselves to giving advice and they should not handle cash or securities.

Some of the malpractices in connection with the activities of registered and unregistered entities acting as Investment Advisers (IA), as reported to SEBI comprise of the following:

- Assured returns being offered by the investment advisers to the clients.

- Charging exorbitant fees from client with a false promise of handsome returns.

- Mis-selling by IA without adhering to the risk profile of the client, to earn higher fees. On receiving complaints for refund of fees from client for loss incurred, IA offer higher risk products to clients with a promise that they will recover their losses.

- Trading on behalf of the clients.

- Automatically upgrading or changing the service to higher risk products, not matching with the client profile and without the consent of the client.

- Poor service by the IA causing losses to the clients.

- Refund related issues.

Investors therefore need to be aware and guard themselves against above mentioned practices present in the market and deal with caution with entities claiming expertise in securities markets. Investors are advised to take advice for investment only from entities registered under SEBI (Investment Adviser) Regulations, 2013.