Factors to Consider Before Investing

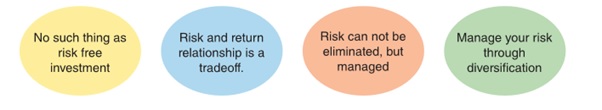

When you invest wisely, your money has the potential to grow faster than money kept in savings bank account. Remember that investing involves potential risks, and there are no guaranteed returns. Therefore, you should equip yourself with the necessary knowledge and information before you start investing.

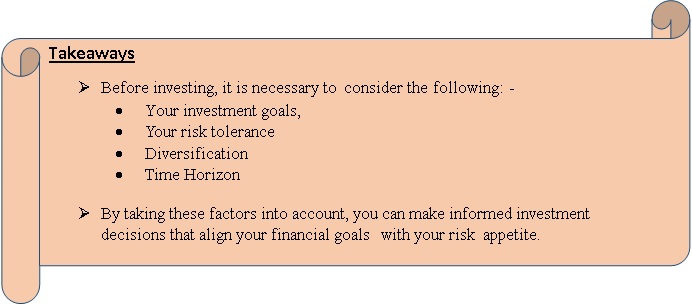

One should consider various factors to make informed and responsible investment decisions:

- Your Goals – Define your financial goals and objectives for investing. Are you investing to purchase a home, planning to build a corpus for child’s higher studies, investing for retirement ?

- Your Investment Horizon – Think of your investment time horizon. A long time horizon allows you benefit from compounding. (Read section on Grow your money with power of compounding)

- Your Risk Appetite – Assess your ability to withstand fluctuations or loss in the value of your investments. Understand that higher-return investments often come with higher levels of risk.

- Investment Knowledge: Start your investment journey by learning basics of investing. If you're new to investing, start with simple and more straight forward investment options before exploring complex ones such as derivatives. (Watch Video on: Take informed decision before trading in derivatives)

- Three Pillars of Investment - You should consider following three pillars of investments

- Safety: Safety refers to the preservation of the invested capital.

- Returns: Returns refer to the potential profits or gains that an investment can generate over a specific period.

- Liquidity: Liquidity is the ease with which an investment can be converted into cash without causing a significant impact on its market value.

- Past Performance vs. Future Potential: While past performance can provide insights, it does not guarantee returns. Focus on the fundamentals and potential of your investments.

- Diversification: Different assets may react differently to economic conditions. Diversification helps reduce the impact of poor performance in any single investment. Diversification can be achieved by investing in different types of stocks, bonds, real estate, commodities, and other assets.

- Asset Allocation:Asset allocation refers to the process of deciding how to distribute your investment capital across various asset classes. The allocation is determined based on an investor's financial goals, risk tolerance, time horizon, and market outlook.

For better understanding, you can take the help of Asset Allocation calculator available at the following link:

https:// investor.sebi.gov.in/ calculators/ Assets Allocations.html - Tax Implications: Consider the tax implications of your investments. Different asset class have different tax treatments.

- Review of Investments: Monitor your investment portfolio regularly and make necessary adjustments such as:

- Rebalancing of your investments to make sure the mix of investments is still in line with your objectives.

- Review your portfolio at important milestones in your life, e.g. when you get married, have children or retire, as your needs may change.

To know more please watch the following videos:

(i) Invest only in regulated products

(ii) Invest karo aur Monitor karo