Grow Your Money with Power of Compounding

Compounding allows savings to grow substantially over a period of time as it involves earning interest not only on the initial amount of money (the principal) but also on the accumulated interest over a period of time. In other words, it is interest earned on the principal and the accrued interest.

Albert Einstein once said: “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't,… pays it”.

The Magic of Compounding

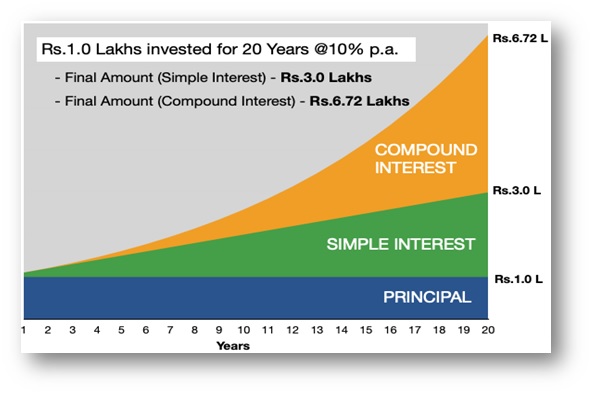

Growth of Rs. 1,00,000 @ 10 % per annum compound interest Vs simple interest for 20 years can be seen in the below picture.

It can be observed, in compound interest, Rs. 1,00,000 has grown to Rs. 6,72,000 at the end of 20 years as compared to Rs. 3,00,000 using simple interest.

To do your own calculations, you may use the Power of Compounding calculator available on SEBI Investor website (https://investor.sebi.gov.in/calculators/power of compounding.html)

Thumb Rules of Compounding:

Thumb rules that can help in understanding the power of compounding are given below:

Time Required (72 / 9 )

= 8 years

Time Required (114 / 9)

= 12.66 years

Time Required (144 / 9)

= 16 years

To know more about Mutual Funds, please watch the following video:

(i) What is Power of Compounding?