Understanding Open-Ended Funds

Understanding Open-Ended Funds

What Are Open-Ended Funds?

An open-ended fund is a type of mutual fund that allows investors to buy and sell shares at their net asset value (NAV) on any business day. Unlike closed-ended funds, which issue a fixed number of shares, open-ended funds have no restrictions on the number of shares they can issue. This structure ensures liquidity and provides investors with the flexibility to enter or exit the fund at their convenience.

How Do Open-Ended Funds Operate?

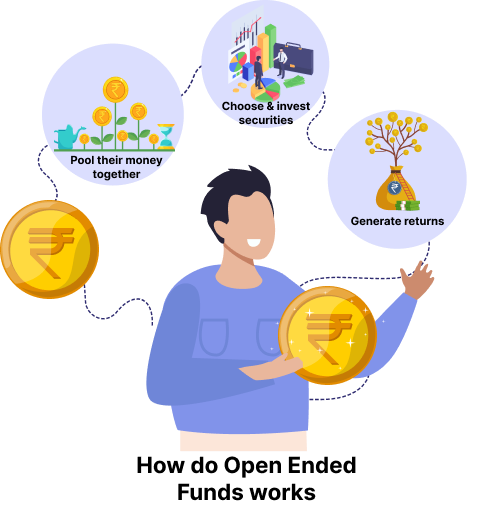

Open-ended funds pool money from multiple investors to create a diversified portfolio of securities, such as stocks, bonds, or other assets. Here’s how they operate:

Continuous Buying and Selling: Investors can purchase or redeem shares directly from the fund at the prevailing NAV, which is calculated daily.

Professional Management: A fund manager oversees the portfolio, making investment decisions aligned with the fund’s objectives.

Liquidity: Since shares are bought and sold at NAV, investors can easily access their money when needed.

Diversification: Open-ended funds typically invest in a wide range of assets, spreading risk and reducing exposure to any single investment.

Wide Variety: Open-ended funds are available in various categories, such as equity, debt, hybrid, and sectoral funds.

Scalability: As more investors join, the fund can grow without limitations on the number of shares issued.