Mutual Funds’ Investments

Net Asset Value

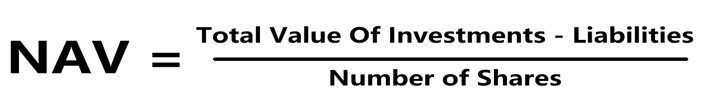

NAV

NAV stands for Net Asset Value. NAV is an important concept for anyone looking to dive into the world of investments in mutual funds,

What is NAV?

Imagine you're a part of a group of friends who decide to pool your money together to buy a large pizza. Each friend contributes some money, and the total cost of the pizza is divided among all of you. The price each person pays represents their share of the pizza.

Now, replace the pizza with a mutual fund, and you've got the basic idea of Net Asset Value. NAV is the per-share market value of all the securities held in a mutual fund's portfolio, minus its liabilities (debts). In simple terms, it tells you the price of one share in the mutual fund. Net Asset Value (NAV) represents the per-unit market value of all the securities held in a mutual fund's portfolio, after subtracting its liabilities (debts). In simple terms, NAV indicates the price of one unit of the mutual fund.

How is NAV Calculated?

Calculating NAV involves a bit of number crunching, but let's simplify it. Imagine you have a jar filled with different types of candies. Each candy represents a different investment within a mutual fund. The total value of all the candies in the jar is like the total value of the securities in the mutual fund.

CalculatingNow, let's say you borrowed a few candies from a friend (liabilities). To calculate the NAV, you subtract the borrowed candies' value from the total value of all the candies. The result is the net value, which is then divided by the total number of candies in the jar (number of shares). This gives you the NAV per unit.

Just as ocean tides rise and fall, the NAV of a mutual fund can fluctuate based on market conditions. Here's a simple analogy to explain this:

Imagine you have a treehouse with different types of fruit hanging from its branches. The value of these fruits represents the value of the investments in a mutual fund. If a storm comes (market volatility), some fruits may fall off, while others may become more valuable. Similarly, market changes affect the value of the investments in a mutual fund. If the overall value of the investments increases, the NAV per share goes up, and vice versa.

Why Does NAV Matter?

NAV is crucial because it reflects the mutual fund's overall performance and its value per unit. Investors often use NAV as an indicator of the fund's health and growth. Here's why NAV matters:

Buying and Selling: Investors buy and sell mutual fund units based on NAV. When you invest in a mutual fund, you are essentially buying shares at the current NAV. When you sell, you'll receive the NAV at that time.

-

Tracking Performance: NAV helps investors track the performance of the mutual fund scheme. If the NAV increases over time, it indicates that the fund's investments are growing in value.

Comparing Funds: When comparing performance of different mutual funds, investors often look at their NAVs. However, it's important to note that a higher NAV doesn't necessarily mean a better-performing fund. It's the percentage increase in NAV that matters.

Dividend Distribution: Some mutual funds distribute dividends to their investors. NAV plays a role in calculating how much each investor receives per share when dividends are distributed.

Fees and Expenses: NAV is used to calculate fees and expenses associated with mutual funds. These fees are subtracted from the fund's assets, affecting the NAV.

Assets Under Management

AUM

AUM stands for Assets Under Management. It is a term you might have come across if you’ve ever dabbled in finance or investment discussions. But what exactly does it mean? In simple terms, AUM refers to the total value of assets that a financial institution or an investment professional manages on behalf of its investors.

What is Assets Under Management (AUM)?

Assets Under Management is a key metric used in the financial industry to quantify the total value of all the assets that a financial advisor, investment firm, or a fund manager oversees. These assets can include a variety of financial instruments such as stocks, bonds, real estate, and more. Essentially, AUM provides a snapshot of the size and scope of an entity's responsibilities in managing its investor’s investments.

How is AUM Calculated?

AUM stands for Assets Under Management. It is a term you might have come across if you’ve ever dabbled in finance or investment discussions. But what exactly does it mean? In simple terms, AUM refers to the total value of assets that a financial institution or an investment professional manages on behalf of its investors.

Significance of AUM

AUM is an important metric for Asset Management Companies such as mutual funds. It reflects the size of the fund and can be used as a measure of the fund’s success in attracting and retaining investors. It is also an important factor while calculating the total expense ratio (TER) charged by mutual funds to its investors.

AUM of a mutual fund is a clear indication of its size and scale. A larger AUM generally indicates that a mutual fund is well-established and has the resources to attract more investors and make larger investments. This can be attractive to investors who are looking for a fund with a solid track record. This can appeal to investors seeking a fund with a proven track record. However, a larger AUM does not necessarily indicate strong past performance.

Asset Management Company

AMC stands for Asset Management Company. An AMC is a financial institution that manages and invests money on behalf of its clients. These clients can be individuals, pension funds, corporations, or even governments. The primary objective of an AMC is to maximize returns on investments while minimizing risks.

An important example of utility of AMCs is investments managed by AMCs of various mutual funds.

An AMC is a financial institution responsible for managing and investing money on behalf of clients, including individuals, corporations, pension funds, and governments. Within the mutual fund industry, AMCs operate under a trust structure, where the fund is established as a trust, and the AMC acts as the investment manager appointed by the sponsor, who meets specific net worth criteria to ensure financial strength. AMCs can be publicly listed or privately held, but all must adhere to stringent regulatory requirements, including a robust corporate governance framework. This includes a dedicated committee for investor protection, typically led by an independent director, to safeguard investors' interests. The AMC's primary role is to maximize returns while minimizing risks, making them essential to the mutual fund structure.

AMCs are supposed to understand their clients' financial goals, risk tolerance, and investment time horizon. Based on the information gathered, the AMC creates diversified investment.

AMCs have teams of experienced and skilled professionals, including fund managers and analysts. These experts analyse market trends, economic indicators, and company performance to make informed investment decisions for the investments in their investment portfolio.

NAV is crucial because it reflects the mutual fund's overall performance and its value per unit. Investors often use NAV as an indicator of the fund's health and growth. Here's why NAV matters:

Professional Expertise: navigating the complex world of investments can be overwhelming for investors. AMCs bring professional expertise to the table which helps its clients to make informed decisions and avoid common pitfalls.

Diversification: AMCs excel in diversifying investments i.e. spreading risk across various assets considering they have a large pool of money to manage. This reduces the impact of poor performance in any single investment on the overall investment portfolio.

Time-Saving: Managing investments requires time, research, and constant monitoring. For those with busy lives or limited financial knowledge, outsourcing this task to an AMC allows individuals to focus on their careers, families, or hobbies while their money is actively managed.

Access to a Range of Investment Options: AMCs often provide access to a wide range of investment options that may not be readily available to individual investors. This includes access to global markets, alternative investments, and sophisticated financial instruments.

Risk Management: AMCs have risk management strategies in place to protect investments from market downturns. Through careful analysis and strategic planning, they endeavour to cushion the impact of economic uncertainties.