SMART ODR

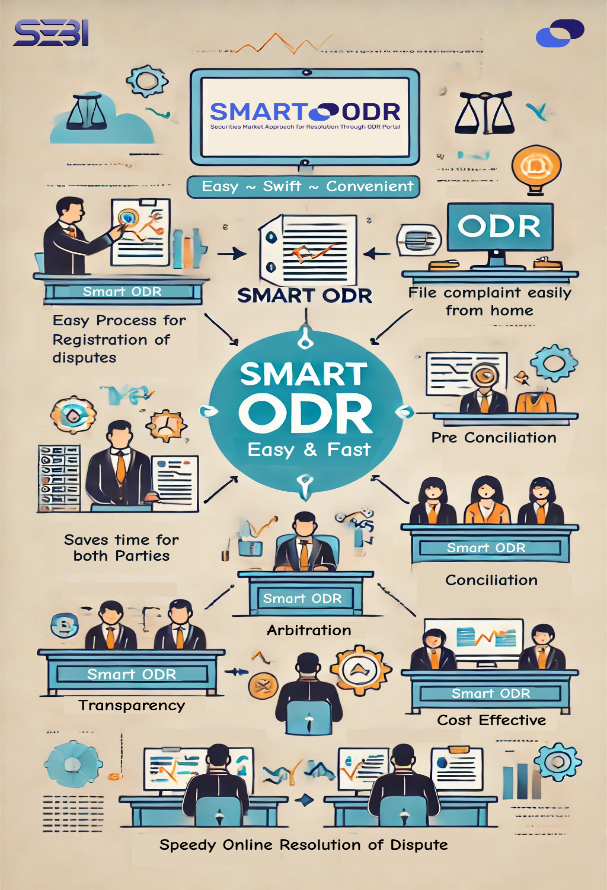

Securities Market Approach for Resolution Through Online Dispute Resolution (SMART ODR)

Securities and Exchange Board of India (SEBI) has taken significant steps to simplify the dispute resolution process through the adoption of Online Dispute Resolution (ODR) mechanisms. Here, we explore how SEBI's forward-thinking approach empowers investors to address issues conveniently and efficiently.

What is ODR?

Online Dispute Resolution (ODR) is a digital extension of the traditional Alternate Dispute Resolution (ADR) process. It leverages technology to resolve disputes outside of courtrooms, providing convenience, transparency, and speed. SEBI’s incorporation of ODR ensures that investors have access to a streamlined process to resolve grievances against listed companies, intermediaries, and market infrastructure institutions.

Significance of ODR Matters for Investors

In a country like India, where millions of investors actively participate in the securities market ODR is very relevant. Key benefits include:

Convenience: Investors can initiate and track grievances from the comfort of their homes.

Cost-Effectiveness: ODR eliminates the need for lengthy and costly legal proceedings.

Speed: Disputes are resolved much faster compared to traditional methods.

Transparency: The entire process is documented and accessible online.

The ODR Ecosystem

SEBI has mandated usage of Smart ODR portal for regulated entities with largely direct individual investor interface. List of securities market intermediaries/ regulated entities against whom

investors may invoke the ODR process are as under:

- Stock Brokers

- Depository Participants

- AIFs–Fund managers

- Banker to an Issue and Self-Certified Syndicate Banks

- CIS –Collective Investment management company

- Commodities Clearing Corporations

- Investment Advisors

- InvITs -Investment Manager

- Merchant Bankers

- Mutual Funds –AMCs

- Portfolio Managers

- Registrars and Share Transfer Agents

- Research Analyst

- REITs –Managers

Smart ODR can also be used for settlement of disputes between institutional or corporate clients and specified intermediaries / regulated entities in securities market as specified in Schedule B, at the option of the institutional or corporate clients like Custodians, Credit Rating Agency, Clearing Corporations etc

ODR Institutions

MIIs has partnered with several reputed ODR institutions to facilitate this process. These institutions are equipped with technology-driven platforms to ensure efficient and impartial grievance redressal. Some notable ODR platforms include:

Centre for Online Resolution of Dispute (CORD)

Centre for Alternate Dispute Resolution Excellence (CADRE)

Webnyay

Presolv360

Sama

Just Act

Jupitice

The ODR Process

The ODR process framework has been designed to be user-friendly. A step-by-step overview is detailed as under

Registration of Complaint: Investors can file their grievances through ODR platform (https://smartodr.in). Details of the complainant like PAN, email, and mobile number is necessary for creating login in the ODR Portal. Relevant documents pertaining to the complainant needs to uploaded. However, one of the pre requisite to file a complaint in SMART ODR is that investor has to take up the complaint with the intermediary before opting for ODR.

Pre- Conciliation Stage: The ODR platform contacts both parties to gather preliminary information and arrive at an amicable resolution

Conciliation: In case no amicable solution is arrived at pre-conciliation stage, then neutral mediators/ conciliators facilitate discussions between the parties to arrive at a mutually agreeable solution. Once a complaint gets referred for conciliation, the dispute will be allotted to any ODR Institutions empanelled by MIIs on round robin basis.

Arbitration (if required): If conciliation fails, arbitration can be initiated. The arbitrator’s decision is binding on both parties.

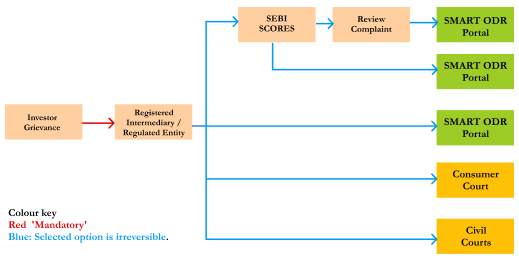

The ODR Flow Chart

Cost Structure for Investors and Entities

The cost structure for pre-conciliation, conciliation, and arbitration is as follows:

Pre-Conciliation: Free for both regulated entity/ intermediary and investor.

Conciliation (to be incurred only by market participant): For successful Conciliation the amount is Rs. 4,800 + applicable taxes and for unsuccessful conciliation the amount is Rs. 3,240 + applicable taxes

Arbitration (to be incurred by both initiator and respondent): Fees for arbitration and ODR Institution depends of the value of claim. Details are as under balanced funds

Investors are advised to refer the circulars on ODR w.r.t cost structures.

Conclusion

Adoption of SMART Online Dispute Resolution marks a significant milestone in investor empowerment. By leveraging technology, SEBI ensures that every investor—regardless of their financial knowledge or geographical location can access affordable swift justice.

Your rights matters and that’s why SEBI is here to safeguard them. Investors should not hesitate to use the ODR mechanism for a seamless grievance/ dispute redressal experience.