Thematic/Sectoral Mutual Funds

Thematic/Sectoral Mutual Funds

Thematic/Sectoral mutual funds are designed for investors who want to invest their money on specific themes or industries. Let’s explore what they are, how they work, and why they might suit your investment goals:

What Are Thematic/Sectoral Mutual Funds?

Thematic/sectoral mutual funds are investment funds that focus on specific sectors, industries, or themes. Instead of investing in a variety of companies across industries, these funds concentrate on businesses that belong to a particular sector or align with a specific theme.

Sectoral Funds: Focus on one sector like IT, healthcare, banking, or energy.

Thematic Funds: These funds are broader than sectoral funds. It follow a theme like renewable energy, digital transformation, or urban development, investing in companies across different sectors supporting that theme.

How Do They Work?

When you invest in a thematic/sectoral fund, investors’ money is pooled with other investors' money. The fund manager uses this pooled money to invest in securities of companies related to the chosen sector or theme. As the companies perform well, the value of your investment grows.

Features of Thematic/Sectoral Funds

Focused Investment: Ideal for investors who believe a particular sector or theme will grow rapidly.

Diversification within a Sector: Instead of buying shares of just one company, you invest in multiple companies within a sector

Higher Returns(with Risks): These funds can generate high returns if the chosen sector performs well, but they also carry higher risk because they lack diversification across industries.

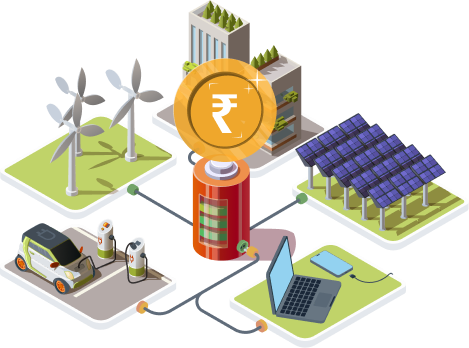

Example of a Thematic Fund

Imagine you believe in the future of renewable energy. A thematic mutual fund focused on "Green Energy" will invest in companies involved in solar power, wind energy, and electric vehicles.

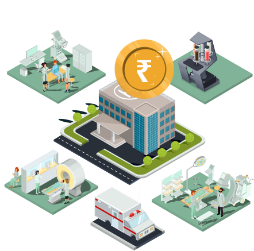

Example of a Sectoral Fund

A healthcare sector fund might include pharmaceutical companies, hospitals, and medical device manufacturers.

Key Points to Consider

Risk: High dependency on one sector means higher risk.

Expertise Needed: You need some understanding of the chosen sector or theme.

Long-Term Growth: These funds work best if the sector/theme has long-term growth potential.