Understanding Mutual Funds

Understanding Mutual Funds

In the article “Why one should invest”, we saw the need for investing one’s surplus money. The investments can be managed by oneself, or through professional help. Mutual fund is one such investment vehicle where any investor can avail the expert services of professional money managers.

What is Mutual Fund?

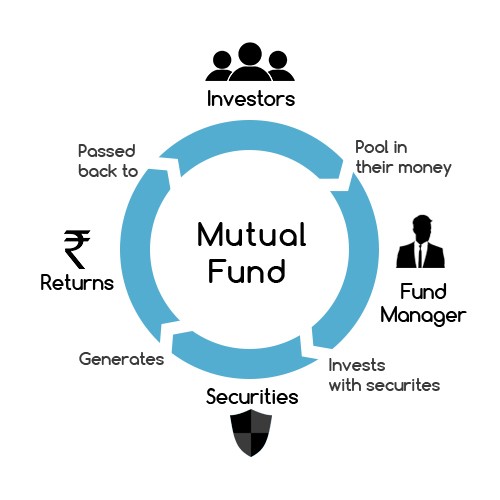

A mutual fund is a trust who collects/pools money from the various investors and invest the money in different types of securities. The investment portfolio managed by a professional organisation known as an asset management company. This company launches schemes (also known as products) by stating certain objectives clearly. An investor can invest into these schemes if the objective of the scheme is in line with the investor’s needs. By investing in a mutual fund scheme, the investor has outsourced the job of managing his money with the asset management company. This company would then: -

Invest the investor’s money in line with the stated objective,

Handle all the research required to select the underlying investments

Keep a track of those investments

Make changes to the portfolio, if required and

Also handle the entire administrative job related to the above.

It will summarise the performance of the portfolio into a statement and give it to the investor, who gets the complete picture on that one page – known as the account statement

Advantages of investing in mutual funds:

Professional management of funds: The mutual fund schemes are managed by professional fund managers. They are registered and regulated professionals.

Low cost: The asset management company charges expenses towards management of the funds as well as paying other professionals that provide other services like fund accounting, custody of securities, auditing, distribution of the schemes, among others. These expenses are capped through regulations by SEBI.

Diversified portfolio: The schemes must hold a diversified portfolio as mandated through SEBI regulations, except in certain cases.

Transparency: Mutual funds must publish the scheme investment objective, upfront. The portfolio where money is invested is disclosed at regular intervals, as prescribed by the regulations. The accounting value of each unit, known as the NAV (Net Asset Value), must be published daily. All material changes in the scheme are to be communicated to the unit holders in a timely manner.

Such transparency allows the unit holders (both existing and prospective) to take informed decisions.Convenience: A mutual fund investment is as easy to operate as a bank account, as on any working day, an investor can make additional investment in the same folio as well as redeem money as may be required.

There are facilities to invest or redeem in a systematic manner – Systematic Investment Plan (SIP) and Systematic Withdrawal Plan (SWP).Strong regulatory framework: Mutual funds are regulated by SEBI through a strong regulatory framework.