Technical Analysis vs. Fundamental Analysis

Technical Analysis vs. Fundamental Analysis

Introduction

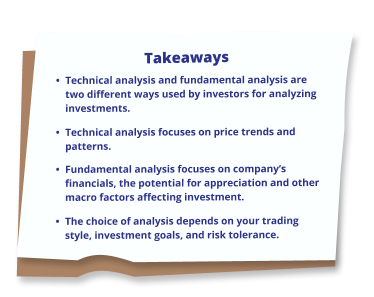

Investing in the stock market is both an art and a science. Whether you are a long-term investor or a short-term trader, understanding Technical Analysis and Fundamental Analysis is important for making better investment decisions

Technical Analysis focuses on price movements, trends and trading volumes, while Fundamental Analysis looks at a company’s financial health, business model and economic factors.

Both methods have their own advantages, and combining them can help investors reduce risk and maximize returns.. Let’s dive into the details.

What is Technical Analysis?

Understanding Technical Analysis

Technical analysis is the study of stock price movements, patterns, and trading volumes to predict future price action. It is widely used by traders for short-term and intraday trading.

Example: If you see a stock forming a "Head and Shoulders" pattern, it may indicate a trend reversal, helping you decide when to buy or sell

| Feature | Description |

|---|---|

| Price-Based Analysis | Focuses on stock price movements instead of company fundamentals |

| Charts & Indicators | Uses tools like moving averages, Relative Strength Index (RSI), Bollinger Bands and candlestick charts. |

| Short-Term Focus | Mostly used for trading and short-term investments. |

| Market Psychology | Assumes that past price patterns tend to repeat due to investor behaviour |

Popular Technical Indicators

Moving Averages (MA) : Helps identify trend direction (Example: 50 day and 200 day moving averages).

Relative Strength Index (RSI): Indicates overbought (>70) or oversold (<30) conditions.

Bollinger Bands: Measures market volatility and helps identify breakout points.

Advantages of Technical Analysis

Quick Decision Making : Helps traders make fast buy/sell decisions based on price movements.

Identifies Entry & Exit Points: Useful for timing market entries and exits.

Works Across Asset: Can be applied to stocks and commodities.

What is Fundamental Analysis?

Understanding Fundamental Analysis

Fundamental analysis examines a company’s financial health, growth potential and economic factors to determine its true value. It is widely used for long-term investing.

Example: If you analyse a company’s earnings, debt levels and industry growth, you can estimate whether its stock is undervalued or overvalued.

| Feature | Description |

|---|---|

| Financial Statement Analysis | Examines a company’s balance sheet, income statement and cash flow. |

| Long-Term Focus | Ideal for long-term wealth creation and value investing. |

| Industry & Economic Factors | Considers GDP growth, inflation, interest rates and sector trends. |

| Valuation Metrics | Uses ratios like P/E, EPS and Debt-to-Equity to assess a stock’s value. |

Important Metrics in Fundamental Analysis

Price to Earnings Ratio (P/E ): Compares stock price with earnings per share (EPS).

Earnings Per Share (EPS): Measures a company’s profitability per share.

Debt to Equity Ratio: Shows a company’s financial leverage.

Advantages of Fundamental Analysis

Helps Identify Quality Stocks: Focuses on companies with strong financials and growth potential.

Reduces Market Noise: Not affected by short-term market fluctuations.

Supports Long-Term Investing: Ideal for wealth creation through compounding.

| Feature | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price trends & trading volume. | Company financials & industry trends |

| Timeframe | Short-term (weeks, days, intraday) | Long-term (years, decades) |

| Tools Used | Charts, RSI, MACD, Bollinger Bands. | P/E Ratio, EPS, ROE, Debt-to-Equity. |

| Best For | Traders & momentum investors | Long-term investors & value investors. |

| Market Impact | Reacts to supply & demand. | Considers economic conditions & business performance |